Rayterton Multifinance

A modern Core Multifinance platform that unifies the full financing lifecycle; Built for financing enterprises that need the convenience of everything under one place

All in one platform.

The Complete Operating System for Your Multifinance Business

Rayterton Core System Multifinance provides a comprehensive solution for financing companies. Our system is designed with these points in mind:

- All in one, no hassle in handling multiple systems at once to handle different steps of

the multifinance lifecycle

- Faster approval and disbursement

- Lower NPF through early warning and disciplined collection

- Controlled COF and liquidity visibility

- Clean GL posting and faster closing

- Audit trail and governance by design

- Modular, modular architecture and open integration layer make it easier for organizations to modernize their Core System without disrupting existing networks.

- Multi-branch, cleanly separate operations, customers, and products between business units and branches in the organization, as granular as you need it

With Rayterton that specializes in customizing solutions to fit your needs 100%, you do not need to worry about disruption or change; the system can follow your existing business processes and operations.

What Rayterton Multifinance Includes

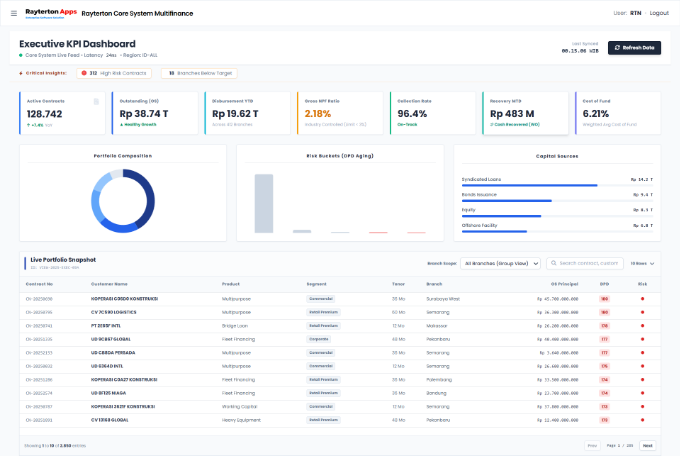

Executive KPI Dashboard

A dedicated page for C-Level (CEO/CFO/COO) to monitor multifinance business health: portfolio, sales, collection, efficiency, and risk, quickly and comprehensively.

This Executive KPI Multifinance Dashboard delivers a comprehensive, real time view of overall business health, covering active contracts and outstanding portfolio to reflect scale and portfolio growth, total disbursement as a measure of funding productivity, net margin and cost of fund to evaluate profitability and funding efficiency, as well as collection rate and recovery performance to assess collection effectiveness and risk quality. Portfolio composition and risk buckets (DPD aging) provide a clear visual breakdown of risk distribution, while capital sources highlight the company's funding structure. All KPIs are supported by a live portfolio snapshot by contract and branch, enabling management to quickly identify risks, trends, and opportunities and make confident, data driven strategic decisions.

This Executive KPI Dashboard is fully customizable to best fit your organization's specific requirements, allowing top management to define and tailor KPIs according to their strategic priorities and management focus. All metrics displayed on the dashboard can be adjusted, added, or refined to ensure executives always monitor the most relevant indicators aligned with their business objectives and decision making needs.

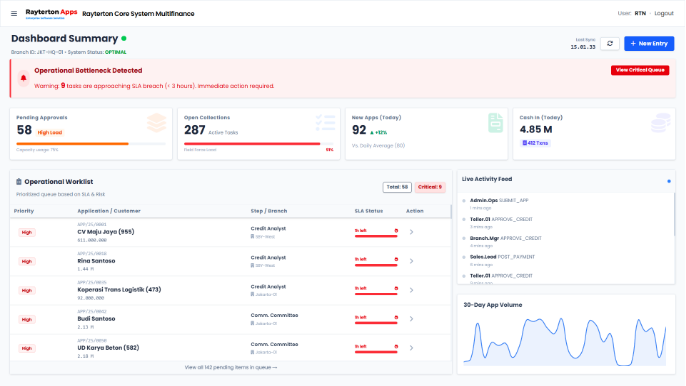

Dashboard Summary

The operational heartbeat of your branch. A tactical control center empowering Branch Managers and Staff to prioritize daily tasks, accelerate approvals, and spot immediate risks instantly ensuring nothing slips through the cracks.

This Branch Dashboard Summary acts as the operational heartbeat of the branch, highlighting pending approvals and open collections to expose workload pressure and execution bottlenecks, new applications today and cash in today to track daily business momentum and liquidity impact, and SLA breach warnings to surface critical operational risks requiring immediate action. The operational worklist prioritizes tasks by risk level, role, and SLA status, ensuring teams focus on what matters most, while the live activity feed provides real time visibility into approvals, disbursements, and payments as they happen. Together with the 30 day application volume trend, this dashboard enables branch managers to accelerate decisions, prevent delays, and maintain tight operational control throughout daily operations.

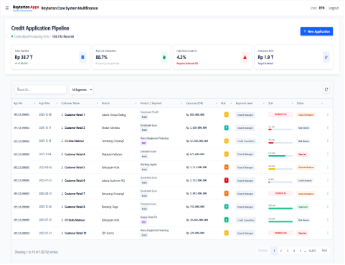

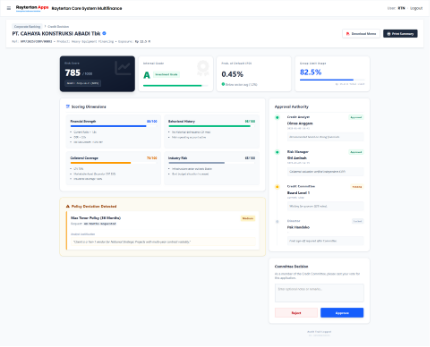

Customer Onboarding in the Rayterton Multifinance System streamlines the entire end to end credit lifecycle, from initial application and KYC verification through credit analysis, approval, contract generation, and disbursement. Designed to align with regulatory requirements and internal credit policies, this feature ensures a fast, controlled, and transparent onboarding process while providing management with full visibility over risk, turnaround time, and portfolio quality from the very first customer interaction.

Built with a user centric and process driven design, the Customer Onboarding feature is exceptionally easy to use, even for complex multifinance operations. Each step follows the real world credit workflow that frontline staff, credit analysts, and approvers already understand, eliminating unnecessary complexity and reducing training time. Intelligent validation, guided data entry, configurable rules, and role based screens ensure users only see what is relevant to their function, enabling faster execution with fewer errors. This combination of enterprise grade depth with operational simplicity positions Rayterton above both global and local multifinance systems, delivering a platform that is powerful for management yet intuitive for daily users at scale

Credit Management

Where everything starts. Once customer data is in, can begin the entire process from loan origination; scoring, verification, then credit approval, and finish with contract execution.

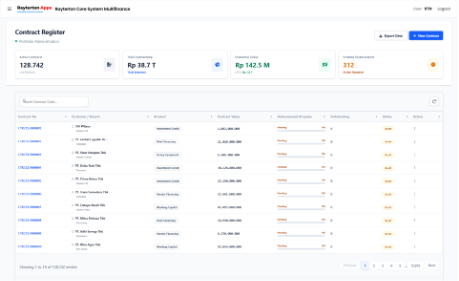

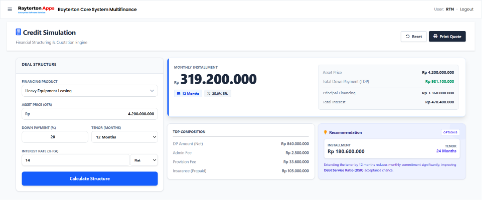

Contracts & Disbursement

Accommodate any financing scheme. From instant credit simulations for sales teams to automated contract generation and disbursement execution, all integrated without re-typing data.

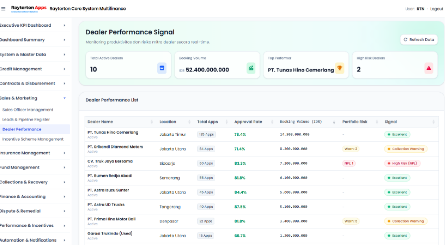

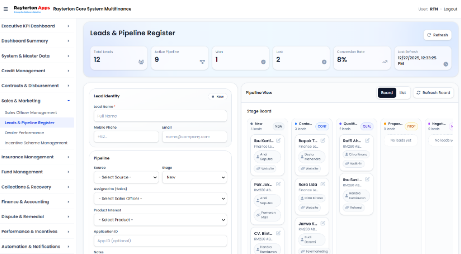

Sales & Marketing

Sales pipeline management, team performance and reward system

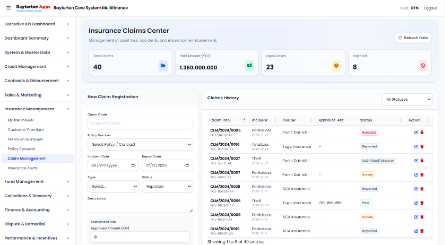

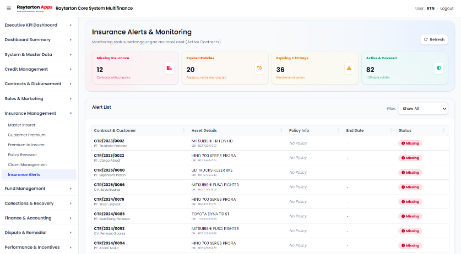

Insurance Management

Customer premium management and manage partnerships with insurance companies

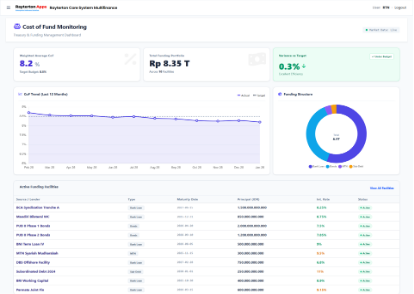

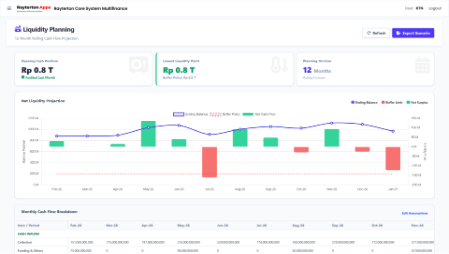

Fund Management

Planning and control of funding sources to maintain COF & liquidity. Dashboards and overviews help oversee funding sources from ongoing contracts, and help the team determine when external sources of funding are required. Plan and determine usage of different funding sources (equity, loans, bonds) or set up joint financing with banks and other financial institutions with risk sharing schemes.

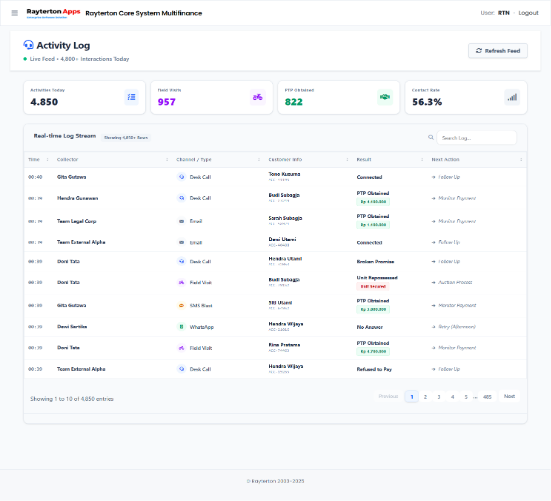

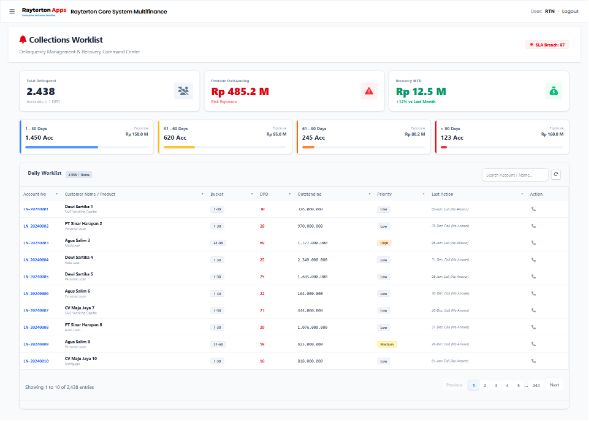

Collections & Recovery

Arrears monitoring, workflow automation, and collector activity tracking. Define collection buckets, assign and manage collection teams, define different collection strategies for each, and track collection activities and history with each contract and customer.

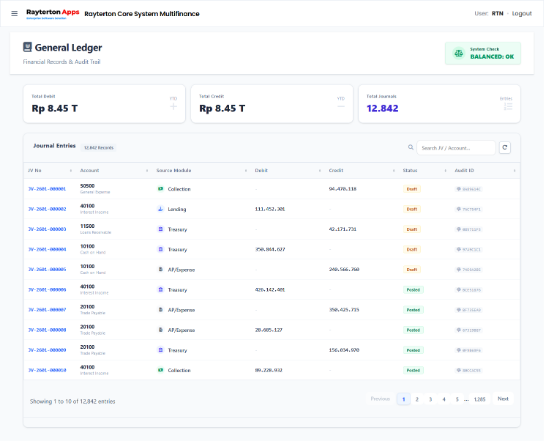

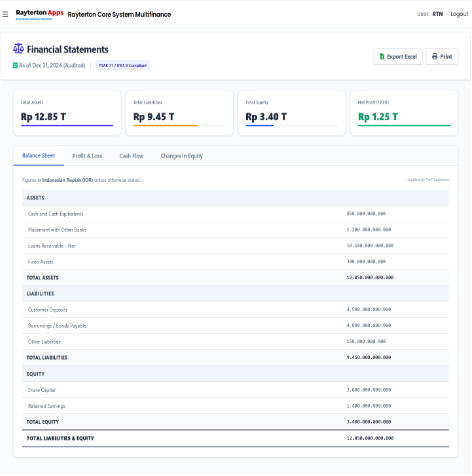

Finance and Accounting

Comprehensive General Ledger (GL) system, from Journals to financial reports. Rayterton can fully customize the accounting process and automation on very specific transactions that your organization requires.

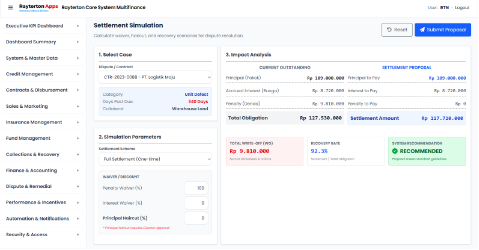

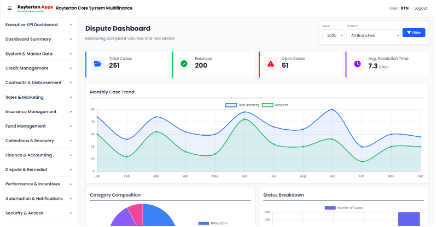

Dispute & Remedial

Manage customer disputes/complaints, mediation processes, legal escalation, & impacts

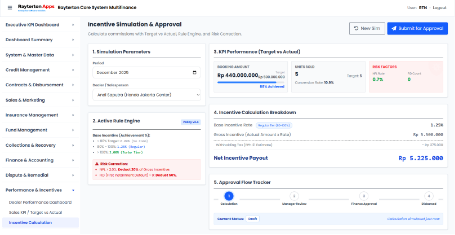

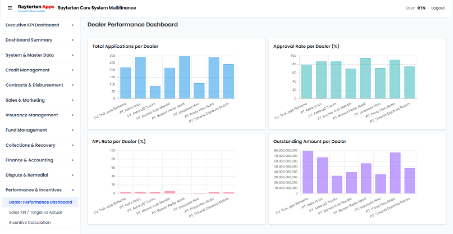

Performance & Incentives

Scorecard for dealers, KPIs for sales, and automatic incentive calculation.

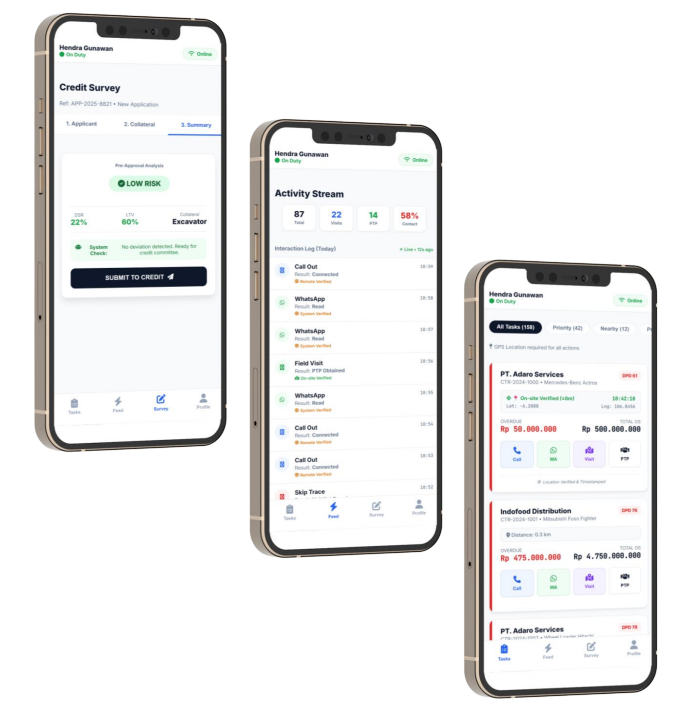

Rayterton Mobile Ecosystem: Field Operation Excellence

Take full control of your field operations. Monitor real-time Collection visits and accelerate Credit Surveys without data entry delays

Ready to fully customize your Core Multifinance System

Provide your credit rules, product configuration, and approval structure. We will tailor and implement the system with your workflows, controls, and reporting dashboards so your Management and Credit Committee can govern decisions with confidence.