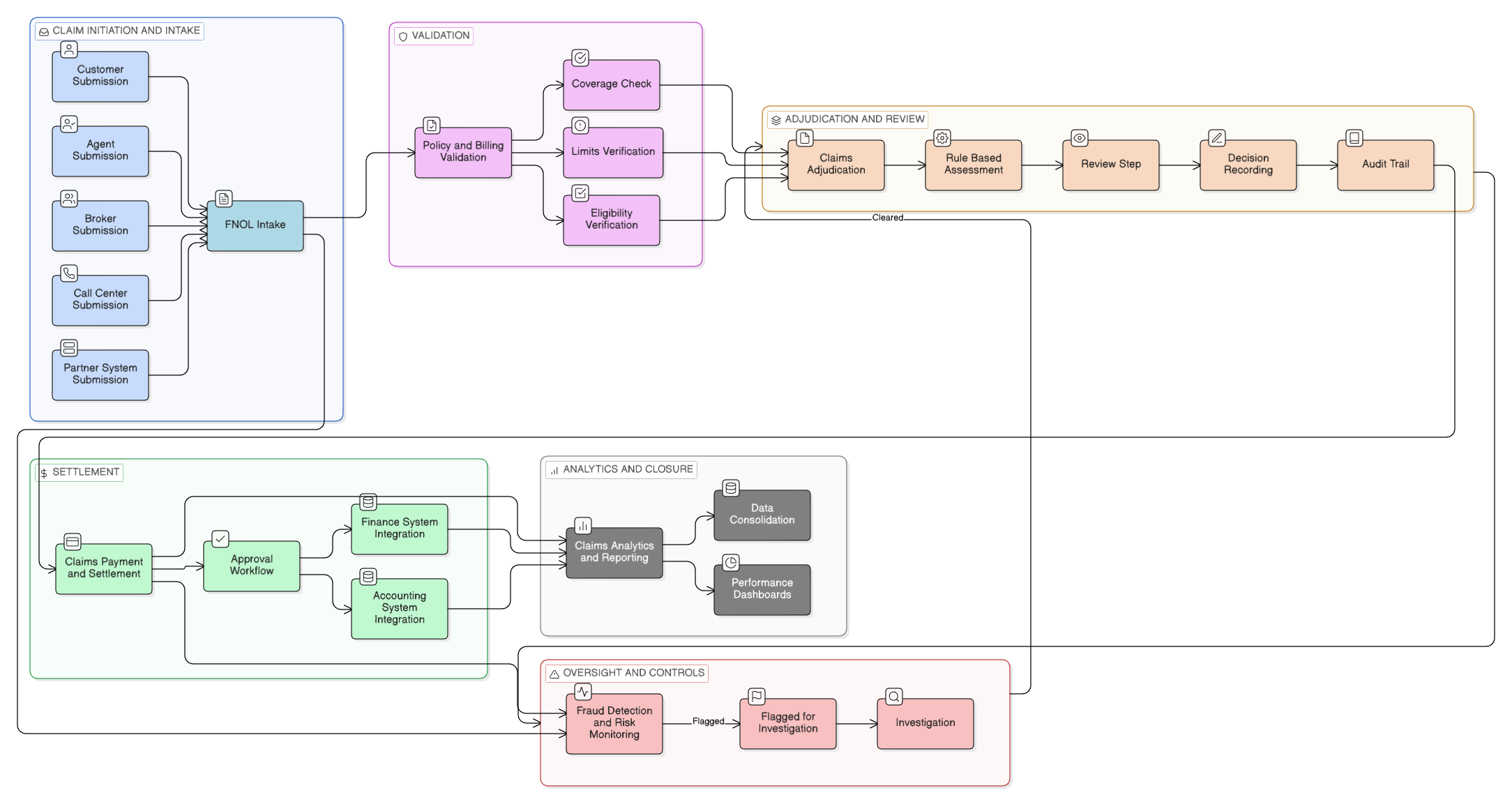

Rayterton Claims Management (FNOL to Settlement)

Claims Management System that connects standardized claim procedures, intake validation, adjudication controls, fraud handling, settlement management, and claims analytics in one operating flow. Designed to keep all claim operations aligned with approved policies and rules while maintaining complete evidence and audit readiness for internal reviews and regulatory requirements.

What Rayterton Claims Management (FNOL to Settlement) covers

- Claims analytics for volume, cycle time, cost, and fraud exposure

- Document and evidence management with audit readiness

- End to end claim handling from FNOL to payment and settlement

- Structured claim review and decision workflows with traceability

- Integration with policy, billing, and partner systems

- Risk monitoring and fraud prevention visibility

End-to-end Operating Story

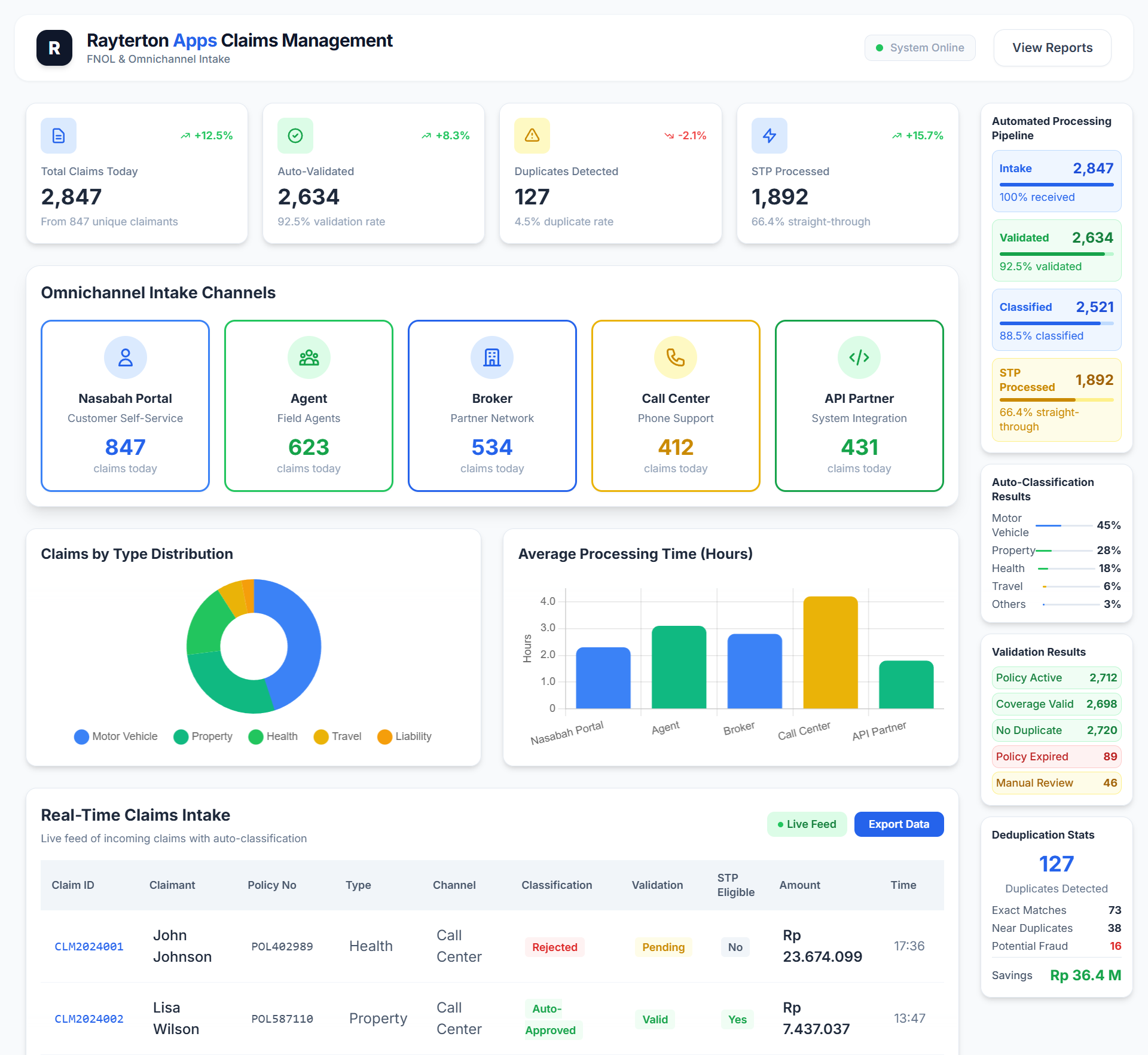

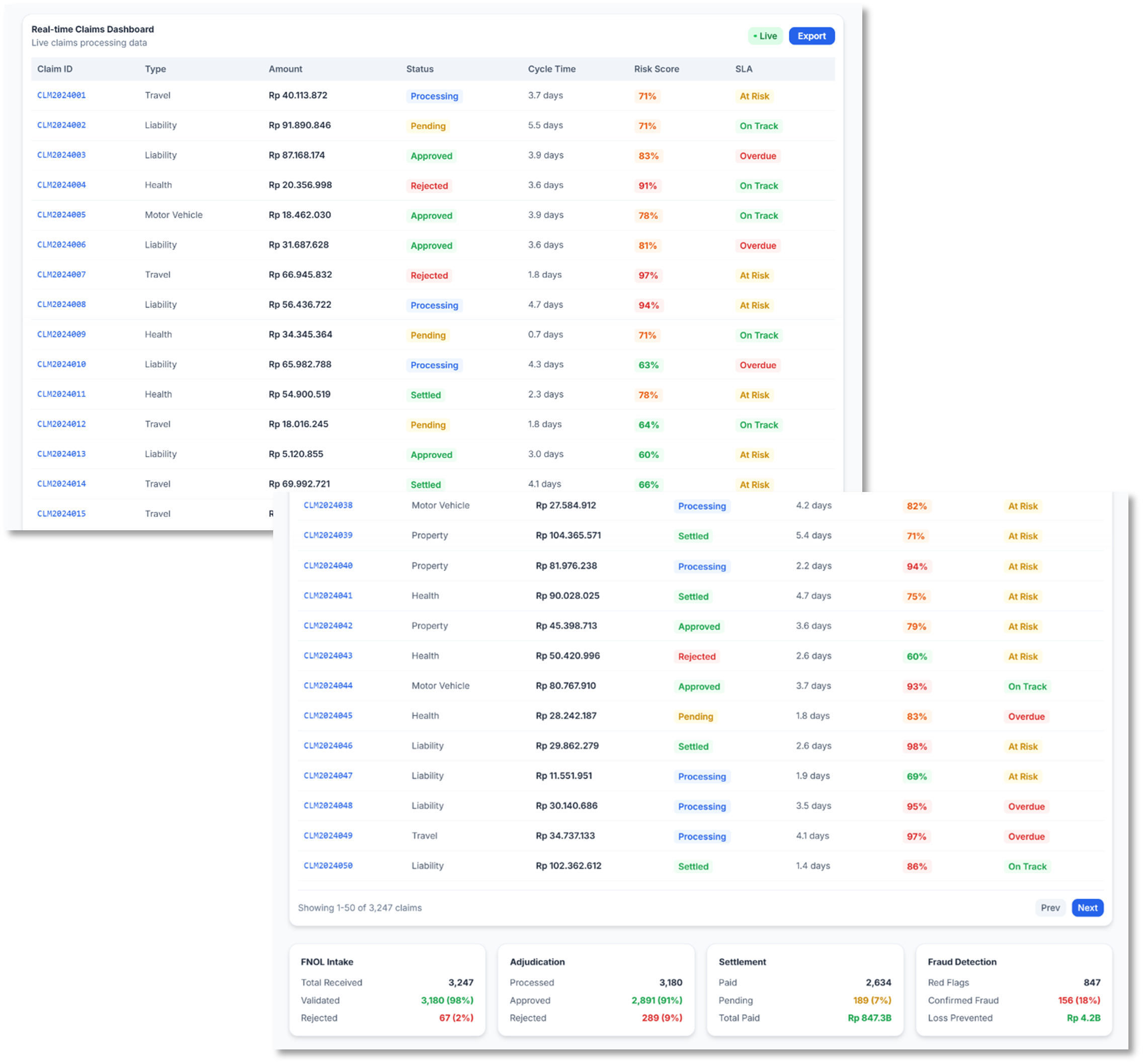

FNOL Intake and Processing

The FNOL Intake and Processing module provides a centralized entry point for all claims. Claims can be submitted by customers, agents, brokers, call centers, or external partners through system integrations, ensuring consistent capture of incident details, supporting information, and initial documentation.

Built in validation, deduplication, and claim classification help ensure data quality at the earliest stage. This enables faster claim initiation, reduces manual rework, and prepares claims for automated processing in subsequent stages.

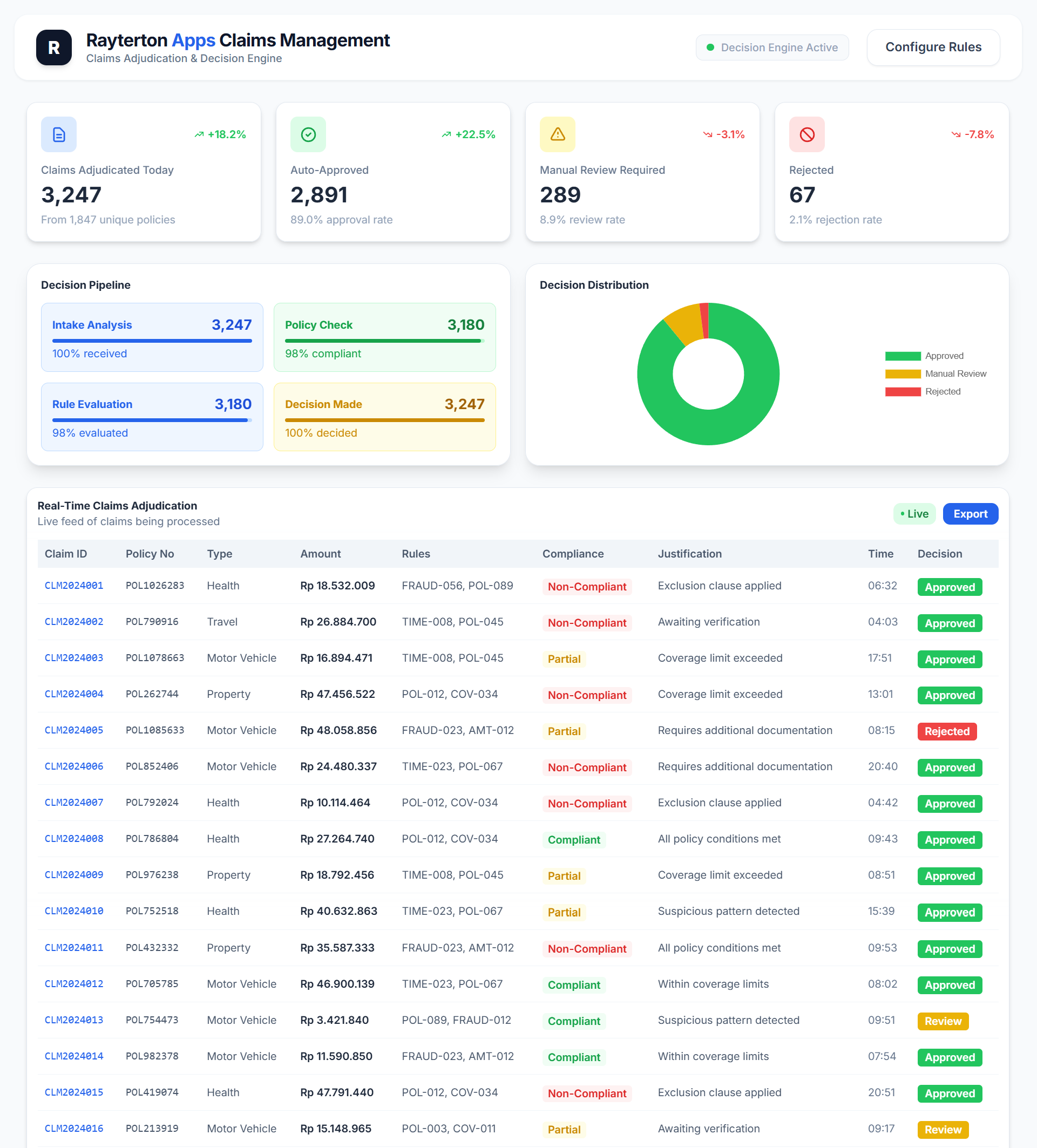

Claims Adjudication

Claim assessment is handled through a structured adjudication process aligned with policy terms and internal rules. The module supports controlled reviews and collaborative decision making within a defined workflow.

Each assessment outcome is recorded with supporting information and complete audit history. This helps maintain consistent claim decisions, improves process transparency, and supports regulatory and internal governance requirements.

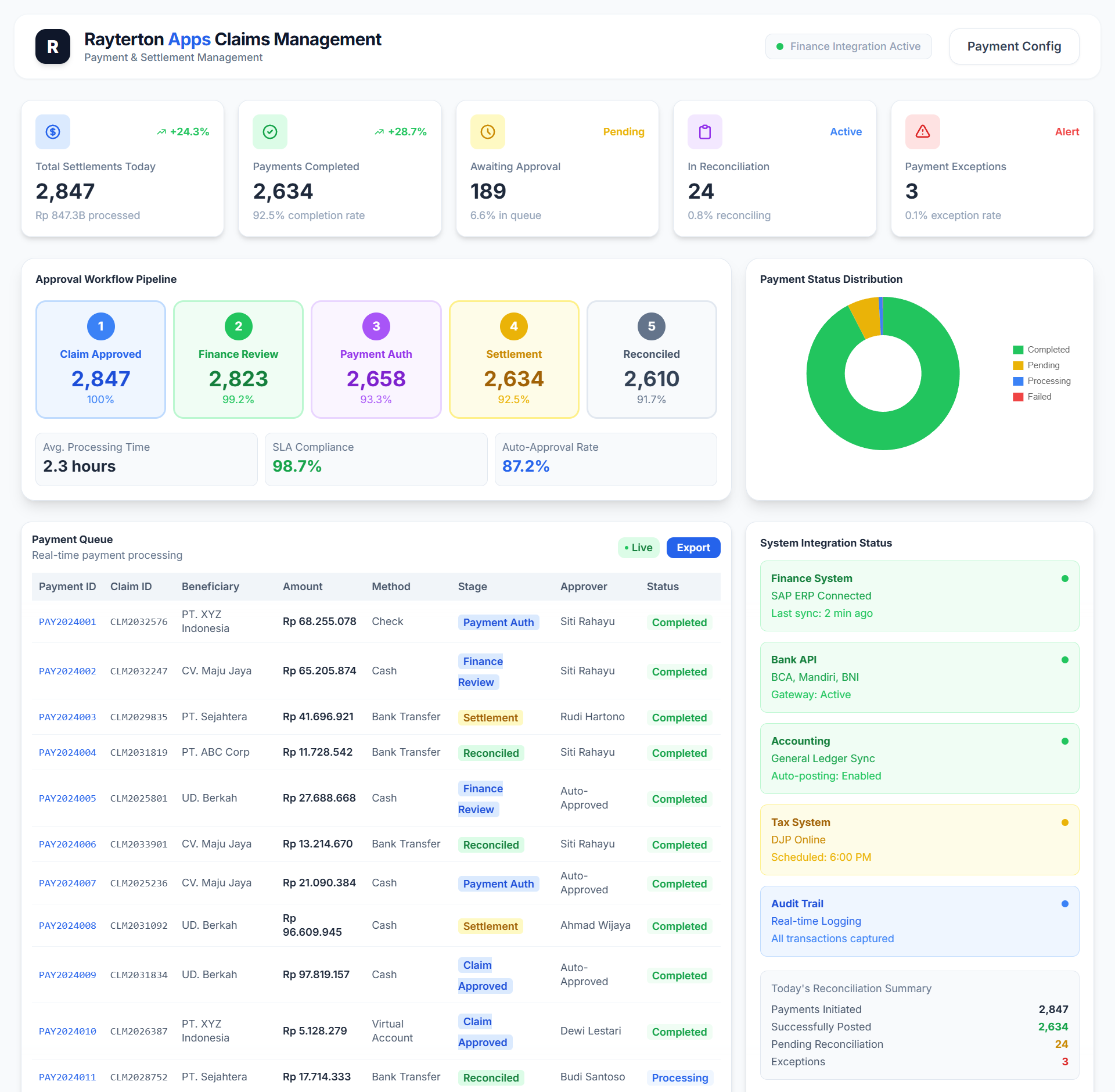

Claims Payment and Settlement

Once a claim is approved, settlement activities are managed through a controlled payment process. Approval steps and payment execution are governed by predefined workflows to ensure accuracy and accountability.

Integration with finance and accounting systems supports reconciliation and financial control. This enables timely settlements while maintaining alignment with financial policies and reporting needs.

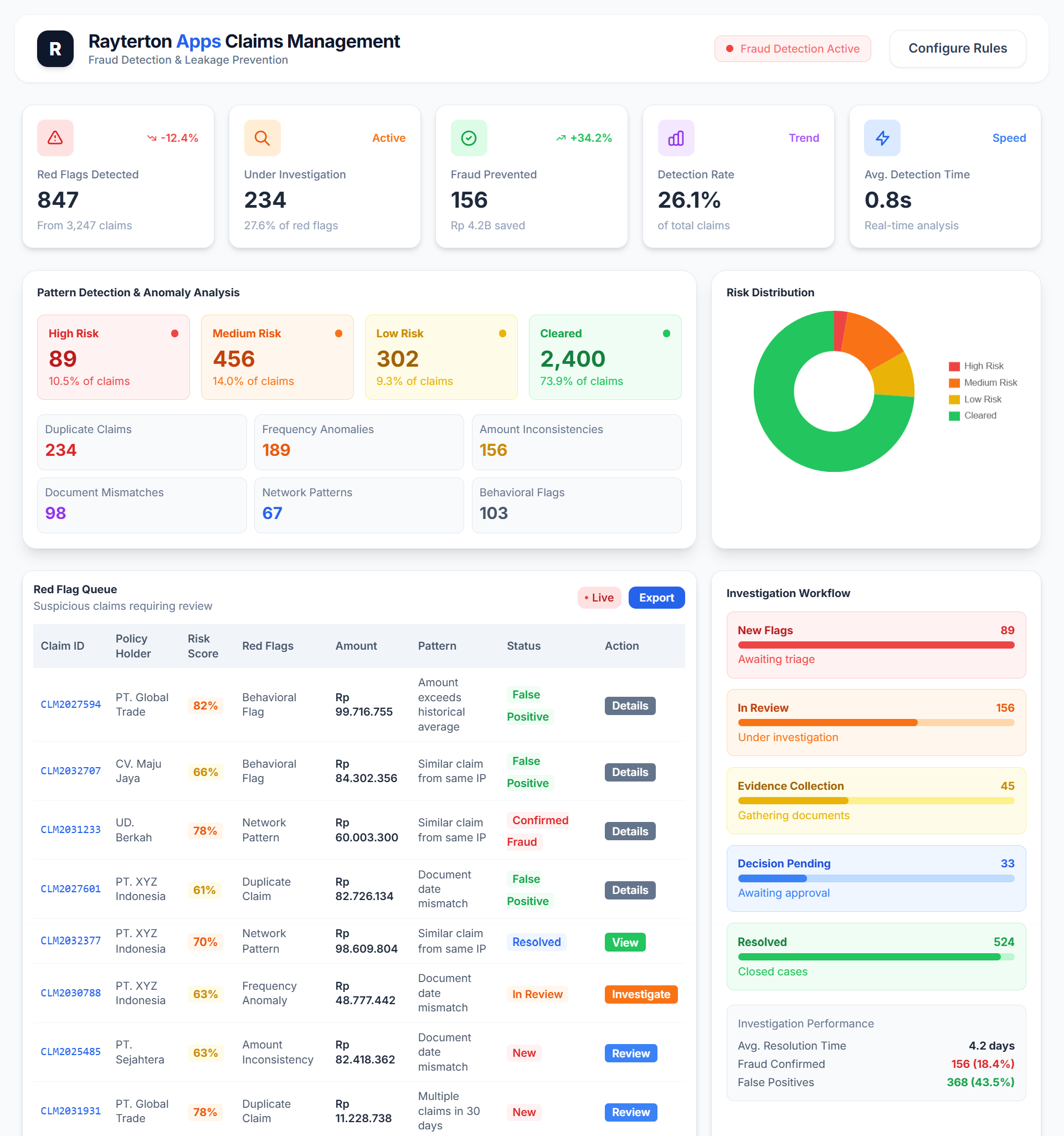

Fraud Detection and Prevention

Risk monitoring is applied throughout the claims lifecycle to identify potential fraud indicators. The system evaluates claims using rule based checks and pattern analysis to detect anomalies that may require further investigation.

Flagged cases can be reviewed without interrupting the processing of valid claims. This helps balance operational efficiency with effective risk management.

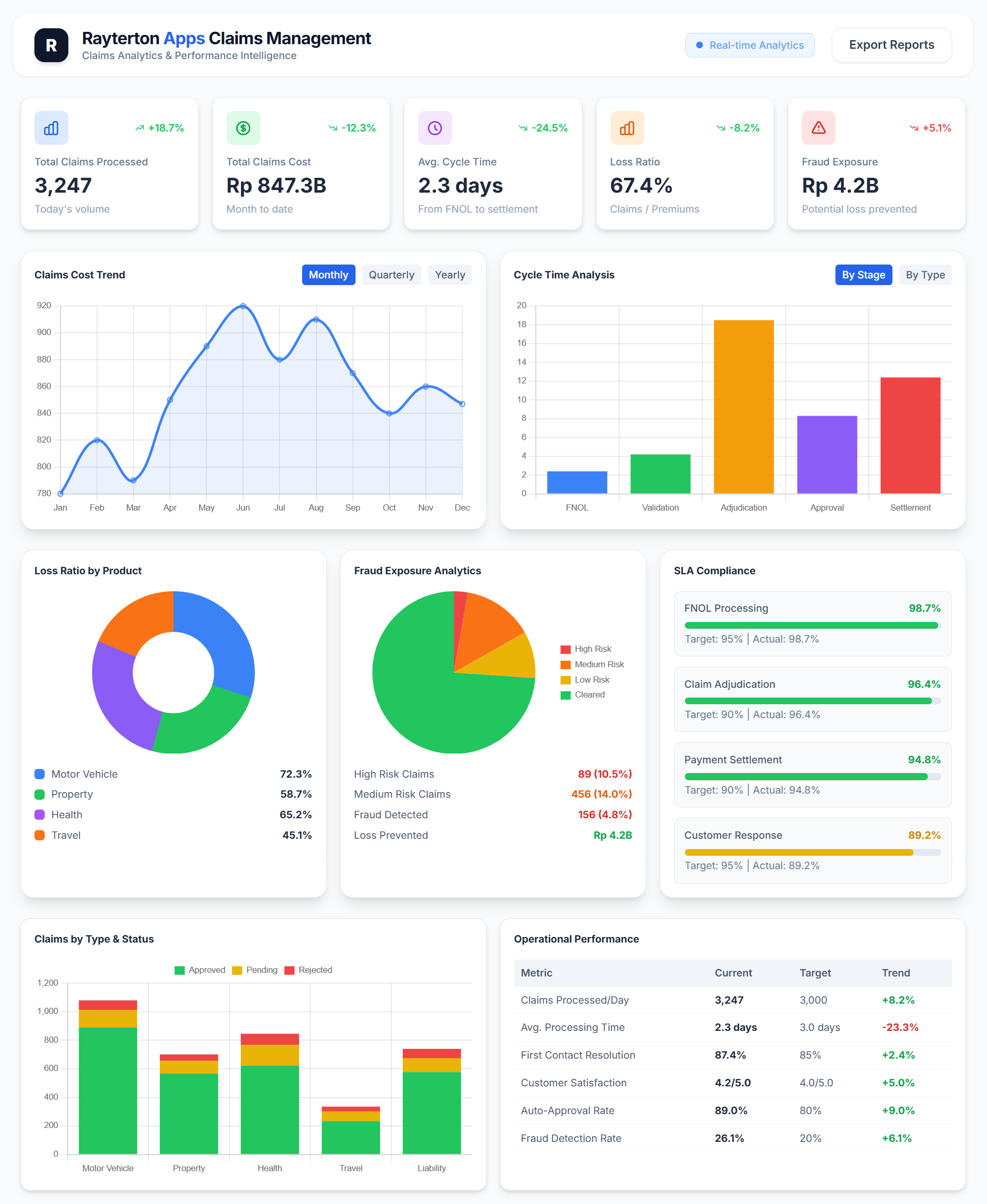

Claims Analytics and Reporting

Operational and performance data from across the claims lifecycle is consolidated into centralized analytics and reporting. Real time dashboards provide visibility into claim volumes, processing timelines, costs, and outcomes.

These insights support performance monitoring and help identify trends that can be used to improve process efficiency and decision making.

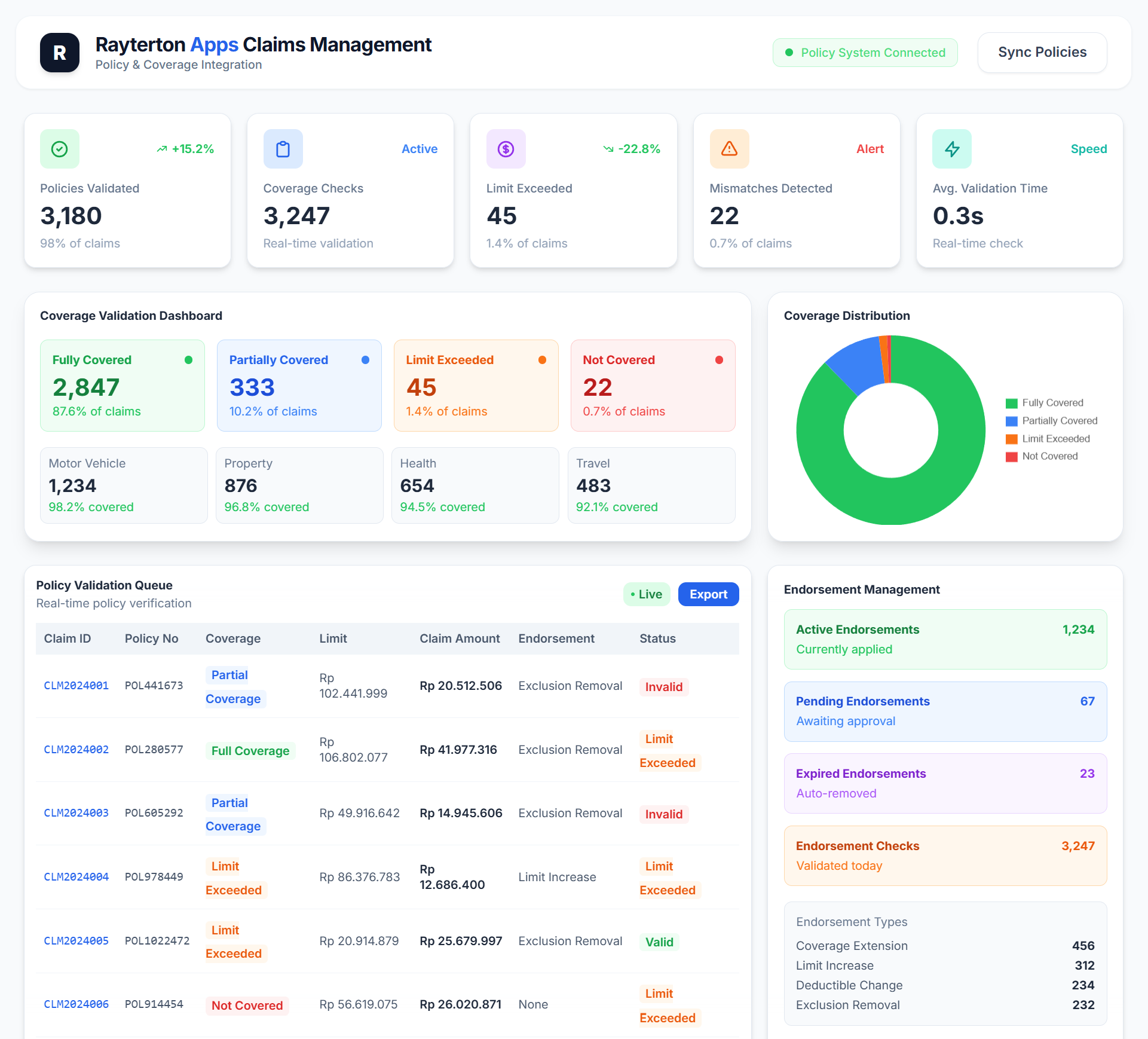

System integration allows policy and billing data to be validated in real time as claims progress through different stages. Potential discrepancies can be identified early, reducing the need for manual checks and rework.

By connecting claims, policy, and financial systems, the organization gains a more complete view of each claim. This supports more accurate processing, improves operational efficiency, and strengthens overall data integrity

The integrated approach also supports better reporting and analysis across functional areas. Consistent data shared between systems enables clearer insights into claim performance, financial impact, and policy utilization.

Integration with Policy and Billing

Claims processing is closely connected with policy and billing systems to ensure data consistency across the organization. Coverage details, limits, policy status, and related financial information are validated during claim handling through system integration, allowing claims to be assessed based on accurate and current data.

This integration reduces duplicate data entry and manual verification while improving overall data accuracy. It also supports an end to end view of claims, policy, and financial information, helping teams work more efficiently and maintain alignment across systems.

Glossary

- FNOL (First Notice of Loss) = The initial notification that a loss or incident has occurred and may result in an insurance claim.

- Claim Initiation and Intake = The process of receiving claims from multiple channels and capturing claim data in a centralized and structured manner.

- Policy and Billing Validation = Verification of policy coverage, limits, eligibility, and related billing information during claim processing.

- Claims Adjudication = The structured assessment of claims to determine validity and settlement outcomes based on rules and policy terms.

- Rule Based Assessment = The evaluation of claims using predefined business rules to support consistent and controlled decision making.

- Fraud Detection and Risk Monitoring = Ongoing monitoring of claims to identify potential fraud indicators and abnormal patterns.

- Claims Payment and Settlement = The execution of approved claim payments through controlled workflows and financial system integration.

- Approval Workflow = A predefined sequence of authorization steps required before claim settlement is completed.

- Claims Analytics and Reporting = The consolidation and analysis of claims data to provide insight into performance, cost, and operational trends.

Ready to fully customize Claims Management to your needs

Share your structure, policies, and pain points. Rayterton will deliver Claims Management customized to your processes, enabling efficient claims handling, fraud prevention, while addressing your main concerns.