Rayterton Actuarial Pricing and Reserving Workspace

The Actuarial Pricing and Reserving Workspace is a comprehensive actuarial solution designed to help insurers manage pricing models, reserve calculations, and reporting within a single integrated platform. It enables insurers to make data-driven decisions, ensure regulatory compliance, and achieve optimal financial outcomes.

Key Benefits

- Integrated pricing and reserving workflow within one actuarial workspace.

- Real-time pricing and reserving analytics.

- Accurate pricing models across insurance products.

- Optimized reserving for future claims.

- Compliance with global actuarial and regulatory standards.

- Seamless integration with policy and underwriting systems.

End-to-End Operating Story

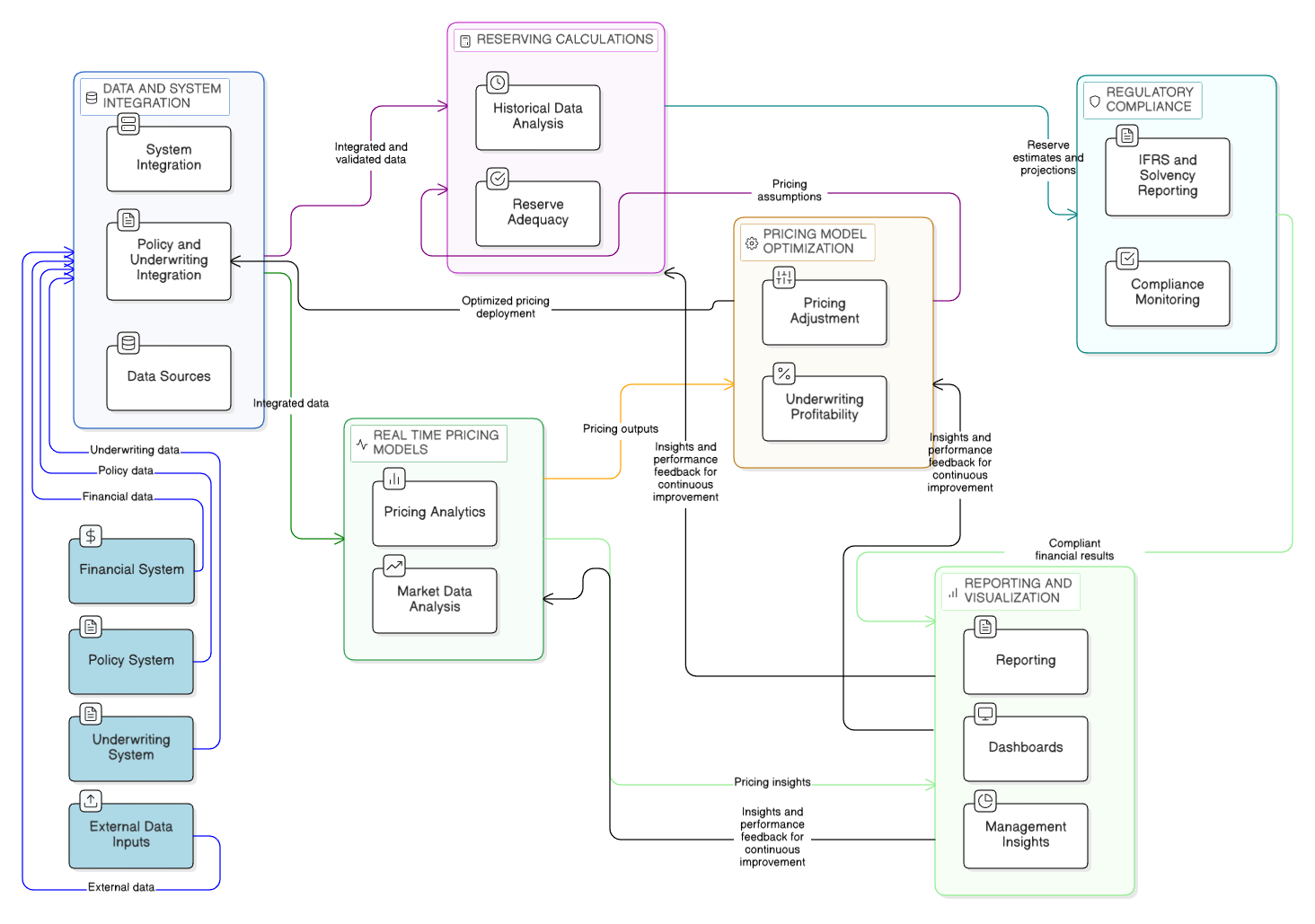

Data & System Integration

The Data & System Integration provides a structured foundation for all actuarial activities across the platform. The application connects directly to policy systems, underwriting systems, and financial systems, enabling consistent data collection across the organization. Through System Integration, Data Sources, and Policy and Underwriting Integration, data is consolidated, validated, and prepared for actuarial use.

This integrated data environment improves data consistency, reduces manual handling, and supports reliable pricing and reserving analysis. The integrated dataset is used as a common input for both Real Time Pricing Models and Reserving Calculations, ensuring alignment across actuarial processes.

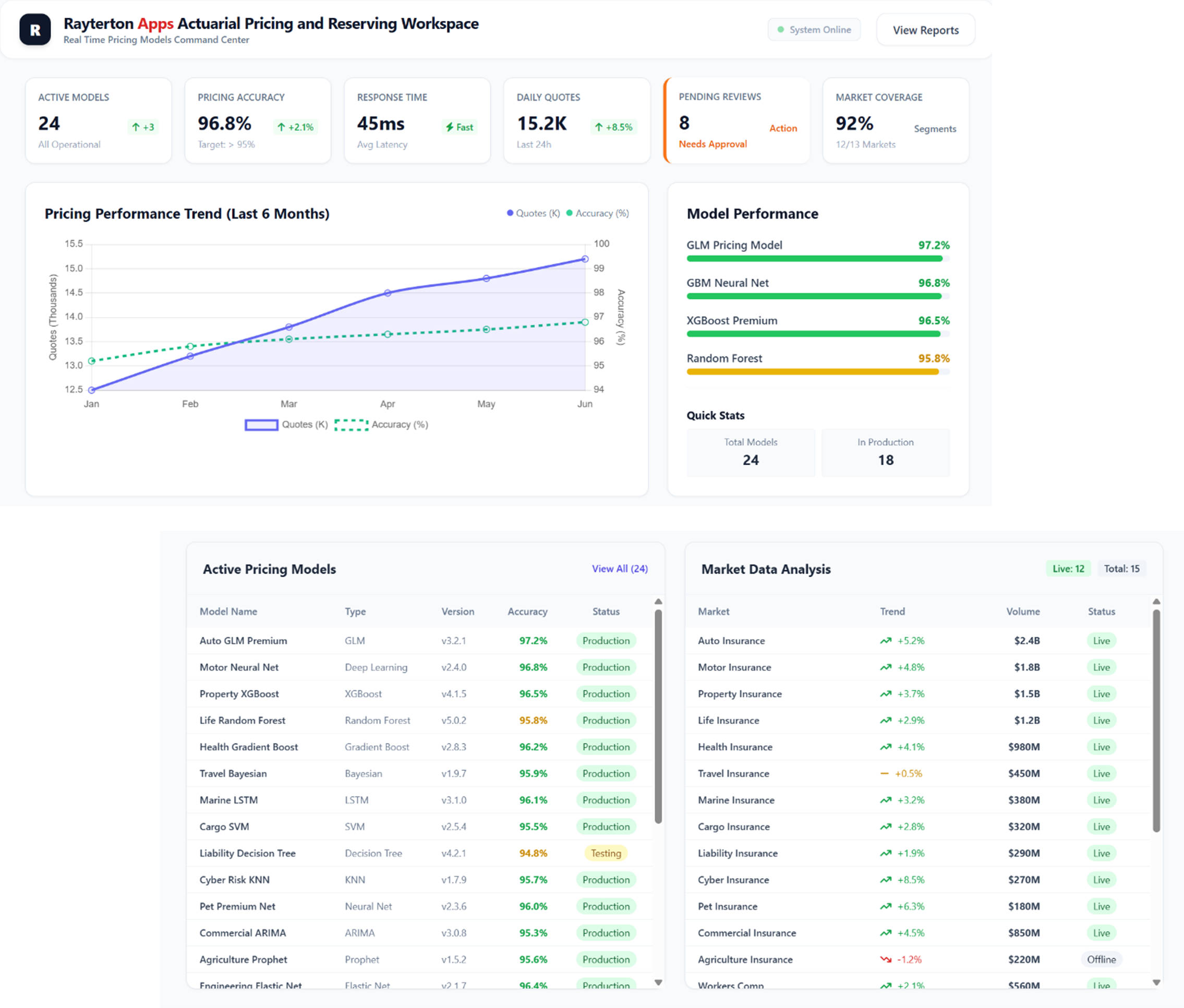

Real Time Pricing Models

Real Time Pricing Models enable continuous monitoring and analysis of pricing performance using current data. Through Pricing Analytics and Market Data Analysis, actuaries can assess market conditions, evaluate product competitiveness, and monitor underwriting profitability on an ongoing basis.

Pricing models are updated as new data becomes available, supporting timely pricing assessment and responsiveness to market changes. Pricing outputs are used to support Pricing Model Optimization activities, inform underwriting strategies, and contribute to management reporting.

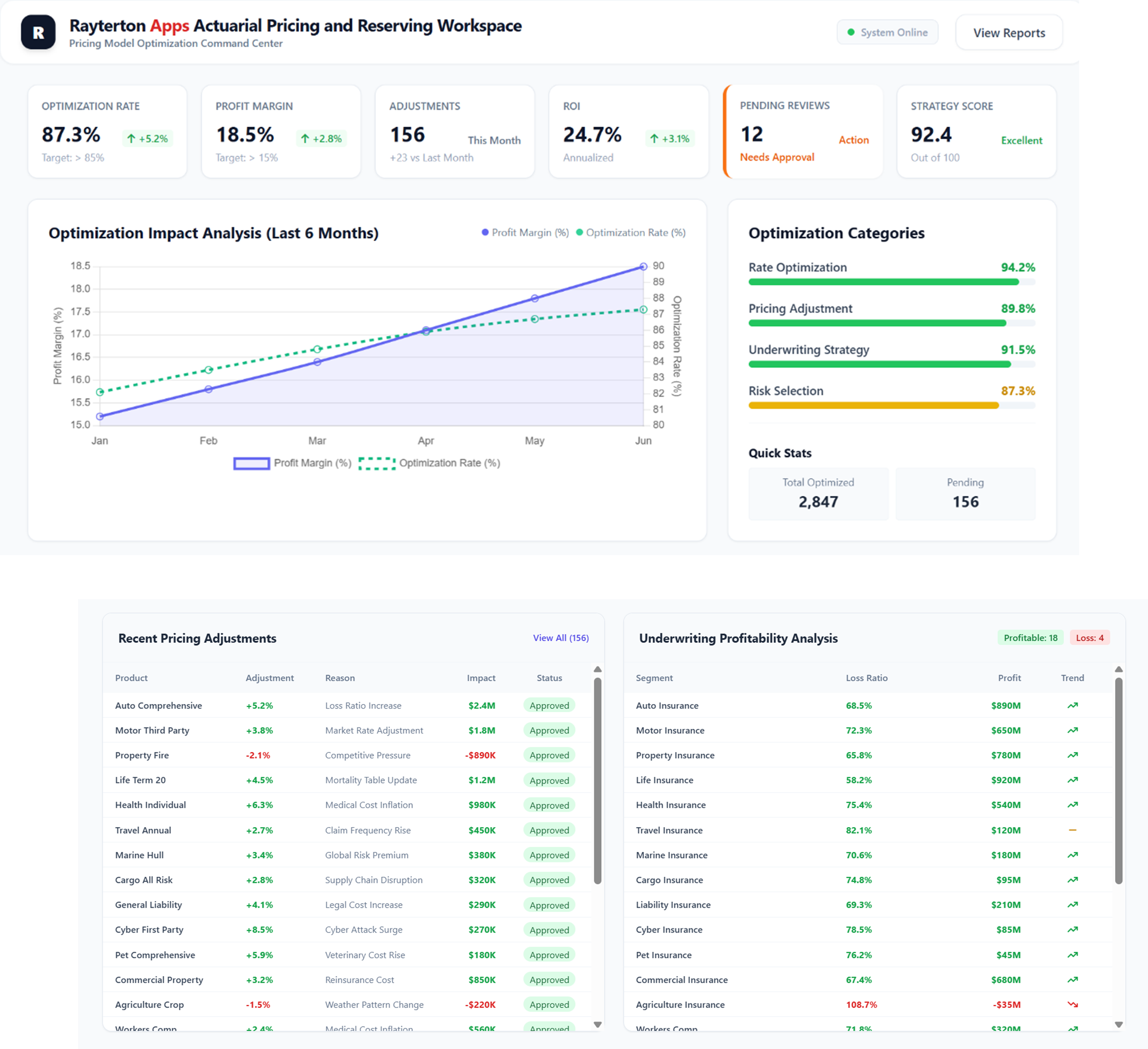

Pricing Model Optimization

Pricing Model Optimization supports structured pricing decision-making based on analytical outputs. Using Pricing Adjustment and Underwriting Profitability analysis, actuaries can evaluate pricing scenarios, adjust rates, and assess the impact of pricing decisions on underwriting performance.

This process supports pricing strategies that align with business objectives while maintaining appropriate risk and profitability levels. Optimized pricing results are deployed to policy and underwriting systems and are also used as inputs for reserving calculations.

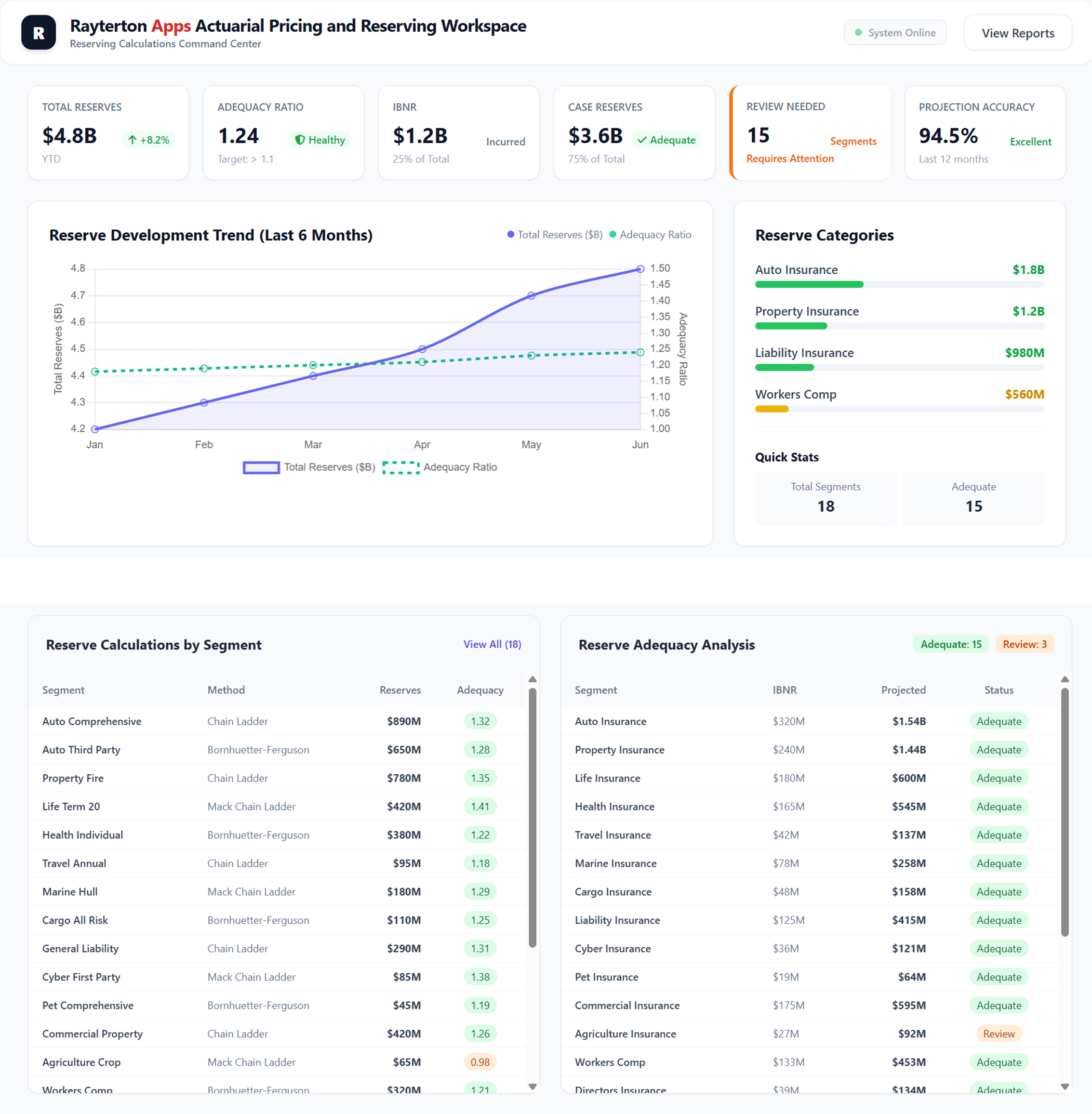

Reserving Calculations

Reserving Calculations support accurate and consistent reserve determination. Through Historical Data Analysis and Reserve Adequacy assessment, the platform calculates reserves based on historical experience, observed trends, and current business data.

This approach supports appropriate reserve levels for future claim obligations and promotes consistency with actuarial principles. Reserving results are used for regulatory compliance, financial reporting, and solvency monitoring activities.

Regulatory Compliance

Regulatory Compliance supports alignment with regulatory and reporting requirements. Through IFRS and Solvency Reporting and Compliance Monitoring, actuarial results are structured to meet applicable global standards.

Calculation processes are documented and traceable, supporting audit readiness and regulatory review. Compliance outputs are used for internal and external reporting, management decision-making, and ongoing financial health monitoring.

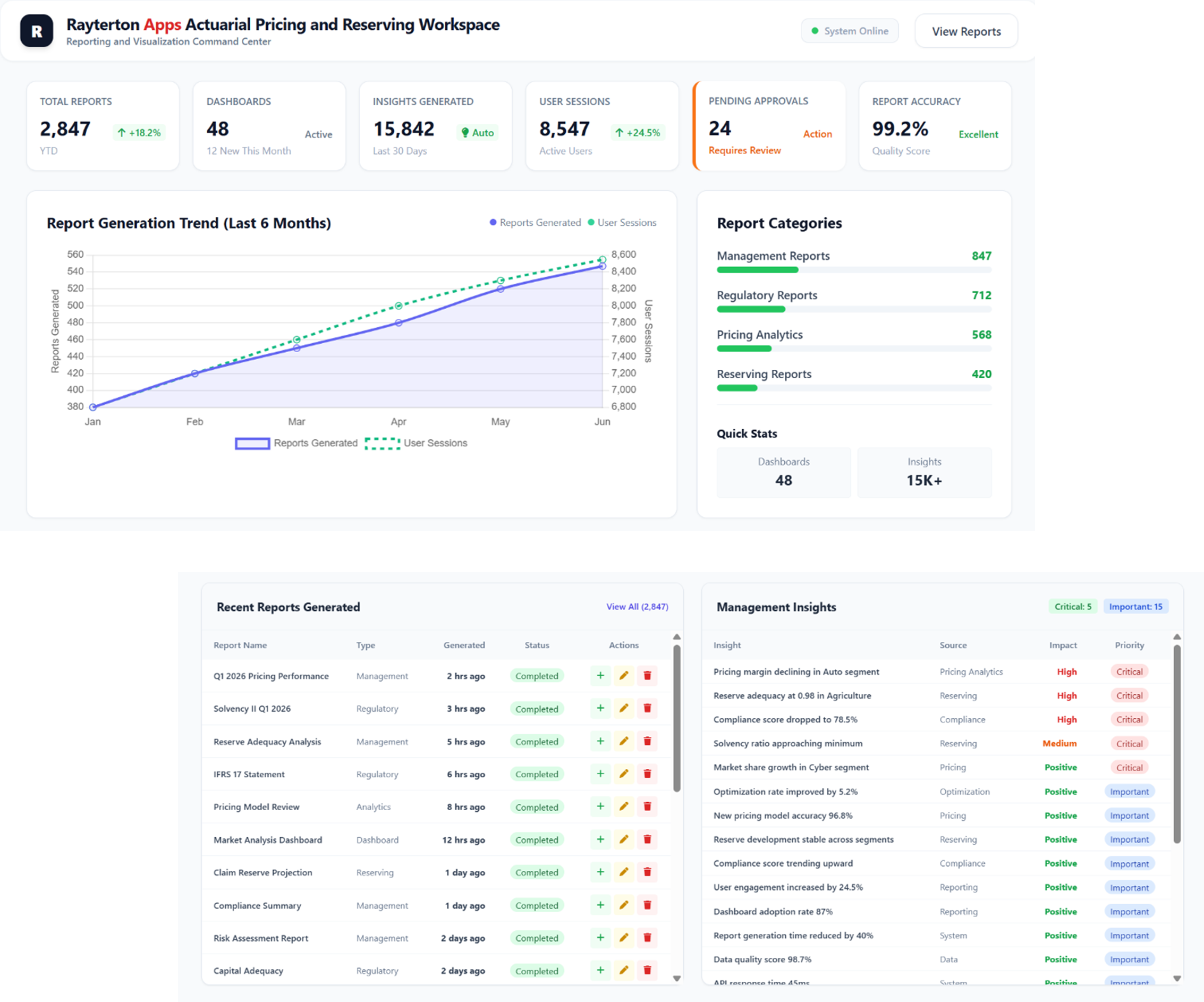

Reporting and Visualization

Reporting and Visualization support clear communication of actuarial results to stakeholders. Through Reporting, Dashboards, and Management Insights, pricing, reserving, and compliance results are presented in structured and interactive formats.

This enables executives and stakeholders to review performance indicators and actuarial outcomes efficiently. Reporting outputs provide structured feedback to pricing and reserving processes by highlighting performance trends, deviations, and emerging risks. These insights enable ongoing monitoring and continuous improvement.

Ready to fully customize Actuarial Pricing and Reserving Workspace to your needs

Share your structure, policies, and pain points. Rayterton will deliver Actuarial Pricing and Reserving Workspace customized to your processes, enabling consistent actuarial workflows, accurate pricing and reserving data, while addressing your main concerns.