Rayterton Core Collection Force Automation

The Recovery Execution Platform.

A focused suite designed to digitize your collection operations immediately. It replaces Excel sheets and manual call logs with a system that enforces the basic discipline: Call, Visit, and Collect.

The Foundation of Recovery Ops.

Digitize Your Collection Force

This platform is designed to enforce collection discipline, ensure cash integrity, and provide full operational visibility across field execution, payment handling, reconciliation, and compliance all under a single, auditable system.

Module Breakdown: The Essentials

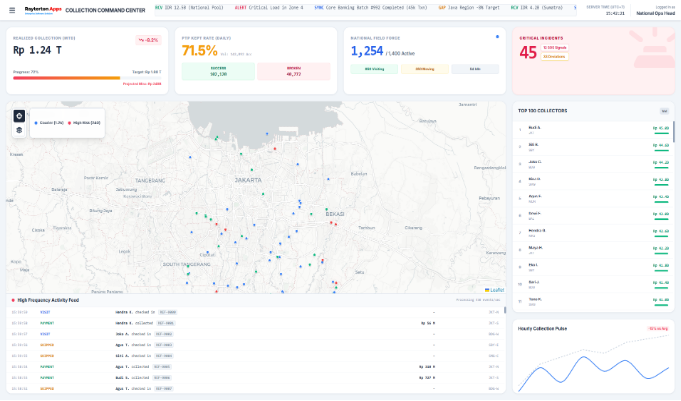

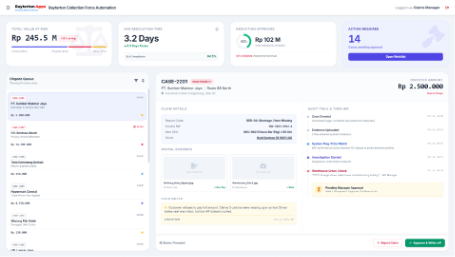

Collection Command Center Centralized, real-time visibility of collection exposure, execution progress, and risk concentration across regions, outlets, and collectors.

Key Capabilities

- Daily collection summary (Outstanding, Collected Today, Overdue)

- Overdue heatmap by area and aging bucket

- Top outstanding outlets with risk indicators

- Collector productivity and effectiveness tracking

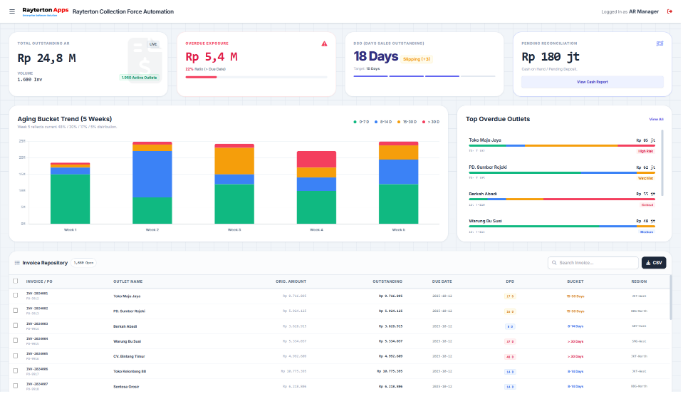

AR Invoice & Aging Maintain strict control over receivables, aging exposure, and overdue risk across outlets and invoices.

Key Capabilities

- Open AR invoice list with real-time balance

- AR aggregation per outlet

- Aging bucket classification

- Overdue risk identification

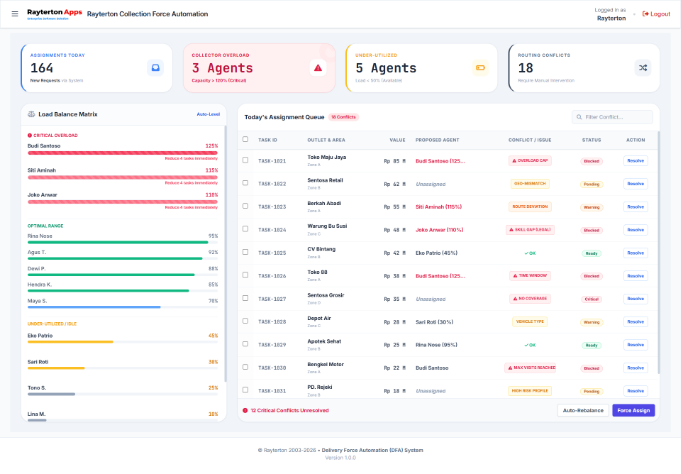

Assignment Management ensures that every collection task is distributed through a controlled, approval-based process, providing full traceability of assignments, reassignments, decision owners, timestamps, and audit trails to maintain operational discipline and accountability.

Key Capabilities

- Assign and reassign invoices to collectors

- Approval-based reassignment

- Full assignment audit trail

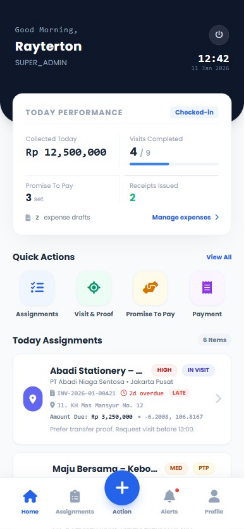

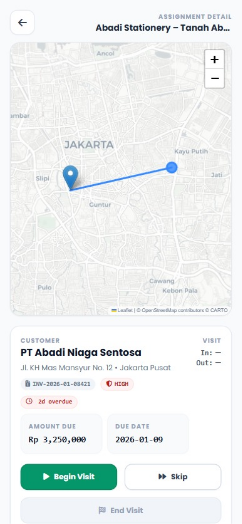

Route & Visit Execution enables structured control and continuous monitoring of field collection activities through planned routes, clearly recorded visit outcomes, and disciplined follow-up actions, ensuring consistent execution, visibility, and accountability across the collection process.

Key Capabilities

- Daily route planning

- Visit list per collector

- Visit outcome classification

- Reschedule and next visit planning

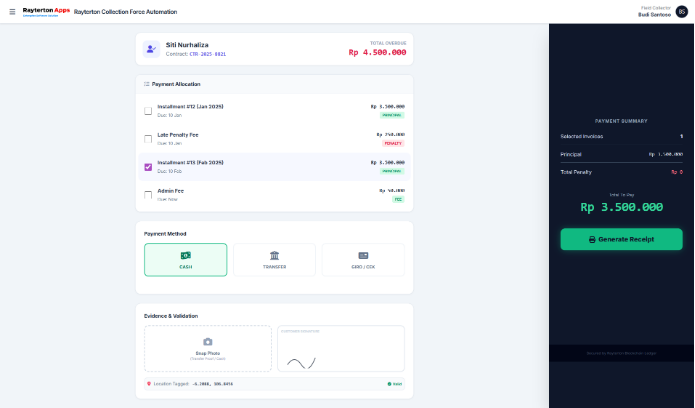

Payment & Evidence ensures that every collection transaction is fully supported by verifiable proof, including payment details, allocation records, physical and digital evidence, timestamps, and traceable references to guarantee accuracy, accountability, and audit readiness.

Key Capabilities

- Cash, transfer, and giro payment input

- Allocation of payment to invoices

- Evidence capture (photo, signature, timestamp)

- Receipt generation

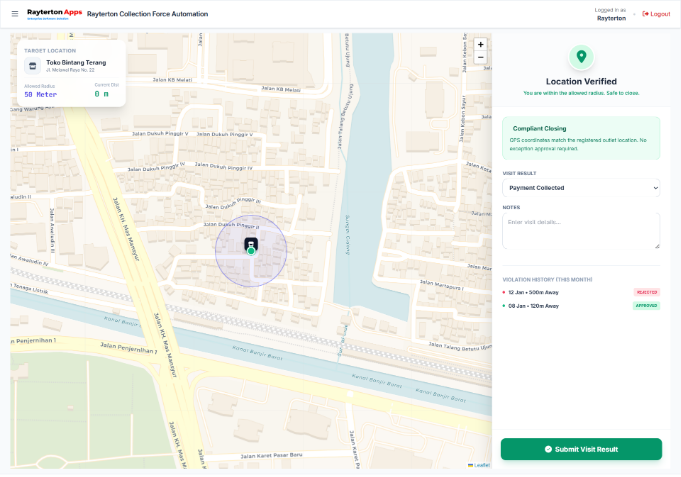

Geo-Fenced Closing Prevent fake visits and enforce location-based collection compliance.

Key Capabilities

- Outlet radius validation

- Exception request outside allowed radius

- Violation logging and approval

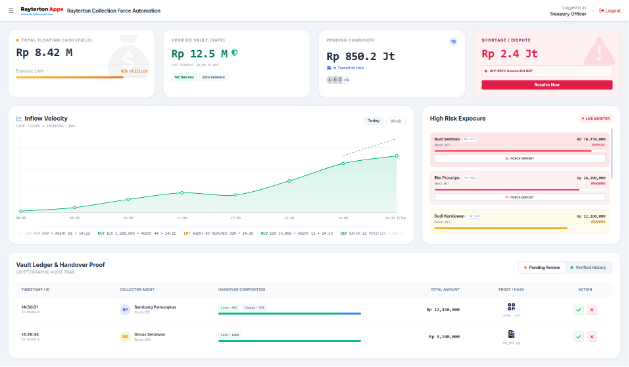

Cash Handling Control physical cash exposure and ensure accountability at every handover.

Key Capabilities

- Cash on hand monitoring per collector

- Cash handover to cashier

- Handover proof and history

Deposit & End-of-Day Closing ensures that daily financial activities are formally closed through systematic reconciliation between deposits and receipts, supported by approval controls and audit trails to maintain accuracy, integrity, and end-of-day financial discipline.

Key Capabilities

- Deposit slip capture

- Reconciliation of deposit vs receipt

- End-of-day closing

- Approval workflow

Dispute & Deduction Management provides a controlled and transparent framework to manage disputes and deduction requests through structured, approval-based, and fully auditable workflows, ensuring every adjustment is justified, traceable, and compliant with internal governance policies.

Key Capabilities

- Dispute case creation

- Deduction request

- Approval and status tracking

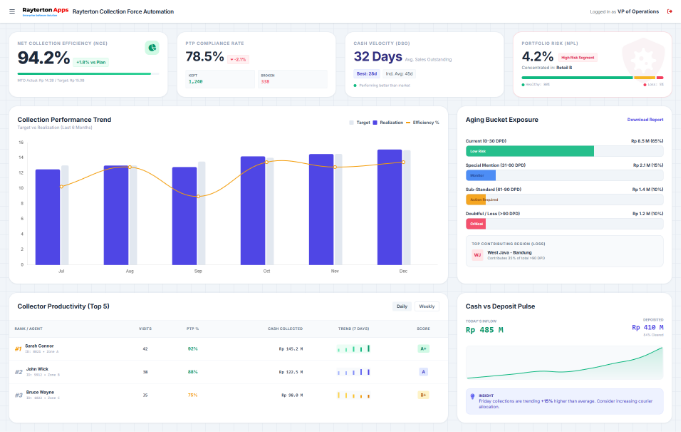

Reporting & Performance Analytics delivers comprehensive and reliable insights to management by consolidating performance metrics, compliance indicators, and risk exposure analysis, enabling informed decision-making, proactive control, and continuous monitoring of collection operations.

Key Capabilities

- Collection performance reporting

- PTP compliance

- Collector productivity

- Aging and overdue analytics

- Cash and deposit reporting

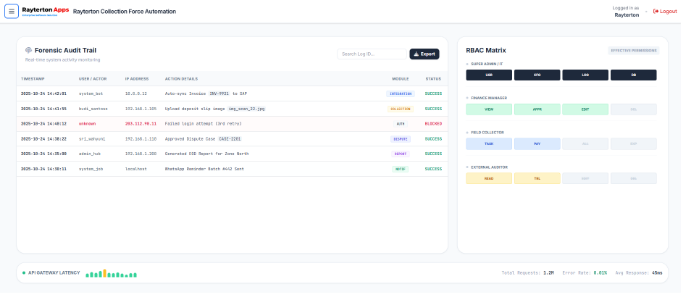

Security, Audit & Integration ensures the platform operates as an integral part of the enterprise's governed ecosystem. Enforce role-based access control, monitor comprehensive audit trails, while also ensuring integration with other systems from one place.

Key Capabilities

- Role-based access control (RBAC)

- End-to-end audit trail

- ERP / DMS AR integration

- Optional WhatsApp reminder and receipt delivery

Stop The Bleeding

Every day you delay, the debt becomes harder to collect. Deploy the Core CFA Suite today. Get 100% visibility of your recovery efforts in under 2 weeks.