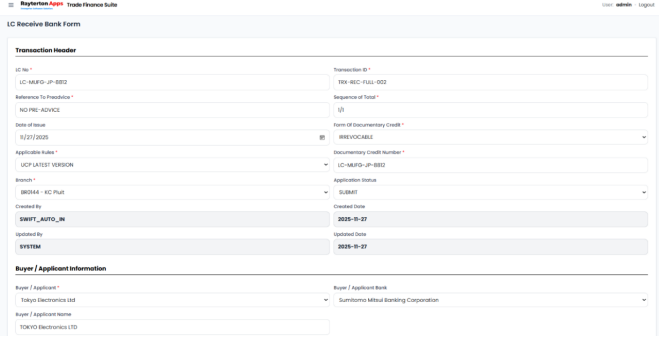

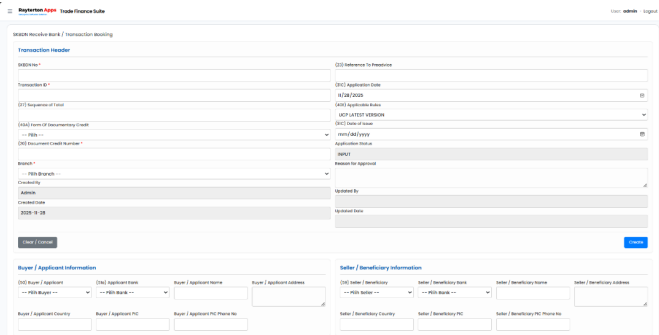

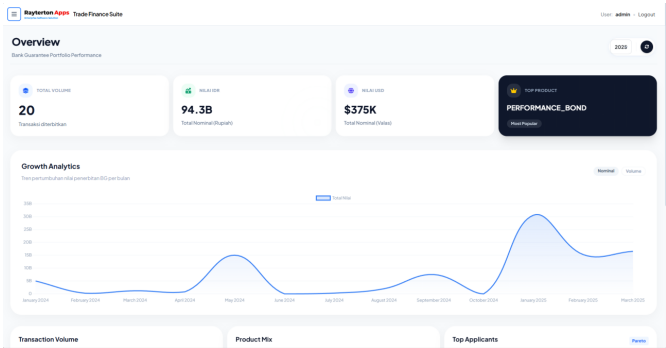

The Enterprise Trade Finance Solution is a cutting-edge, mission-critical web-based platform meticulously architected to streamline and revolutionize the complex landscape of global and domestic trade operations. This robust ecosystem serves as the financial nerve center for banking institutions, seamlessly integrating end-to-end transaction processing—from the initial issuance of Letters of Credit (LC) and SKBDN, through the intricacies of Documentary Collections, to the final settlement of Bank Guarantees. By digitizing these traditionally paper-intensive processes, the system bridges the gap between Applicants, Beneficiaries, and Correspondent Banks, creating a unified, transparent, and highly efficient workflow that eliminates operational friction and enhances cross-border connectivity.

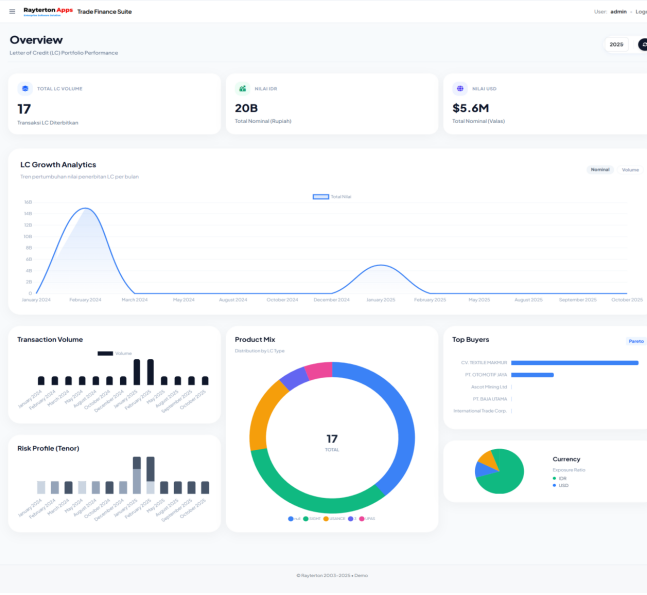

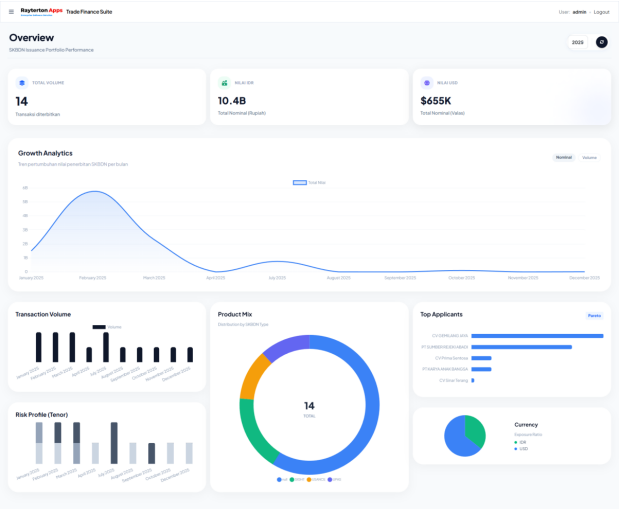

The primary objective of this system is to maximize operational velocity while rigorously mitigating the inherent risks of international commerce. It is strategically designed to ensure strict adherence to global compliance standards, thereby significantly reducing discrepancy rates and regulatory penalties. Empowered by advanced capabilities such as automated sanction screening, dynamic credit limit monitoring, and intelligent liquidity forecasting, the solution provides stakeholders with real-time visibility into their trade portfolios. This comprehensive control enables financial institutions to deliver precise, secure, and high-speed trade services that foster trust, drive client business growth, and exceed the evolving demands of the modern global market.

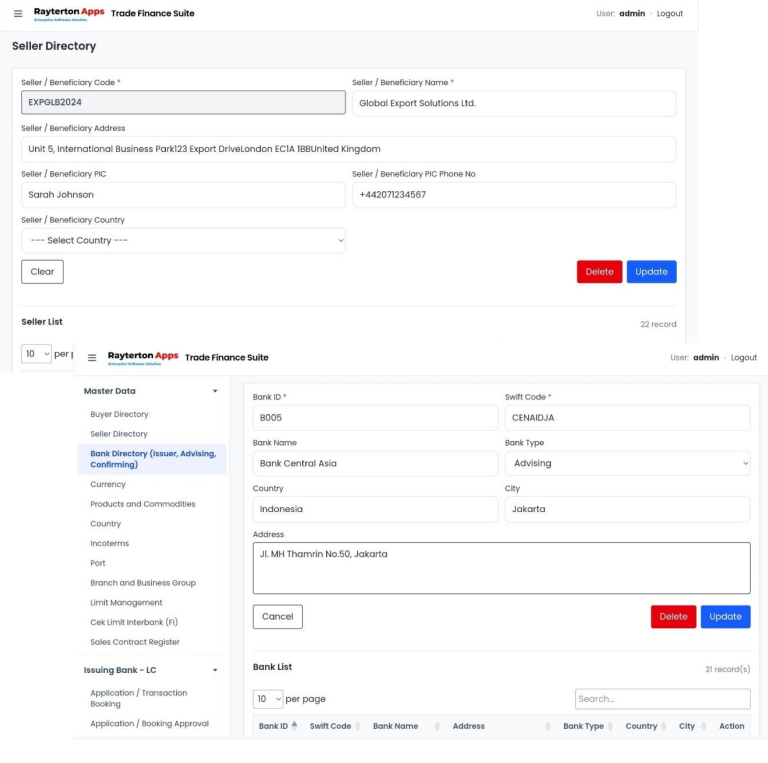

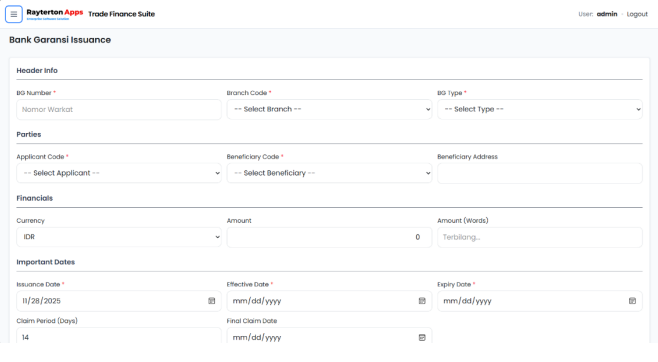

Master Data serves as the core foundation that ensures accuracy, consistency, and control across all Trade Finance transactions. This module centrally manages critical reference data including Buyer and Seller directories, Correspondent Bank profiles (Issuing, Advising, and Confirming), currencies, products and commodities, incoterms, ports, and credit limit configurations. By maintaining a single, validated source of truth, banks can significantly reduce operational errors, strengthen compliance with internal policies and regulatory requirements, and accelerate the processing of Letters of Credit, SKBDN, and Bank Guarantees. Designed for high-volume, multi-branch, and cross-border operations, Rayterton's Master Data module delivers enterprise-level governance, transparency, and scalability for modern trade finance environments.