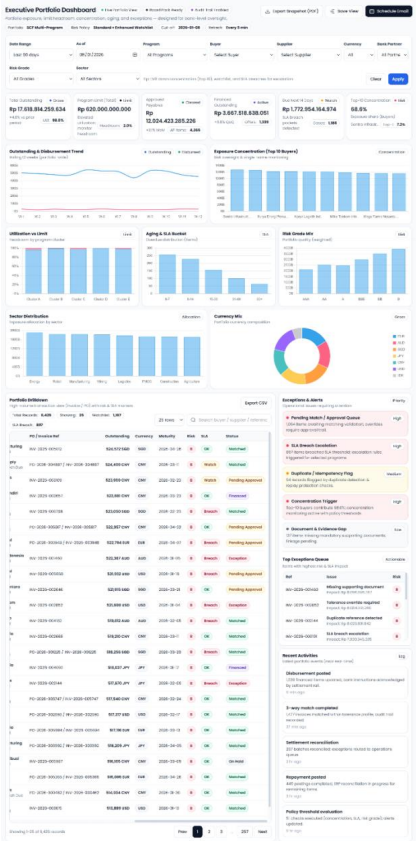

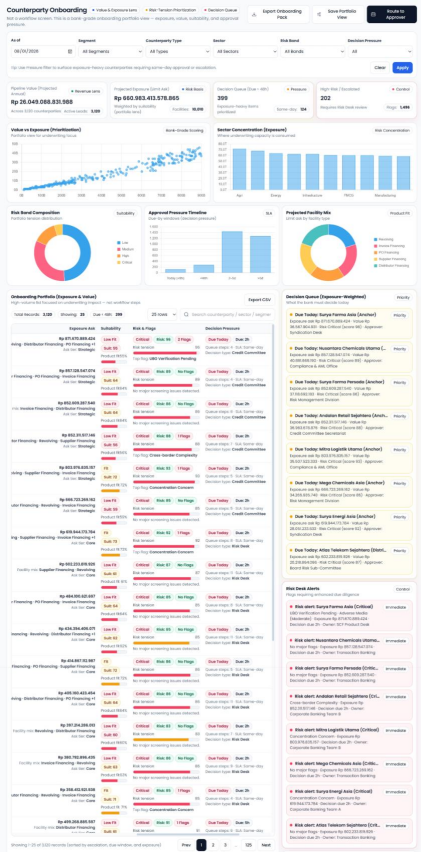

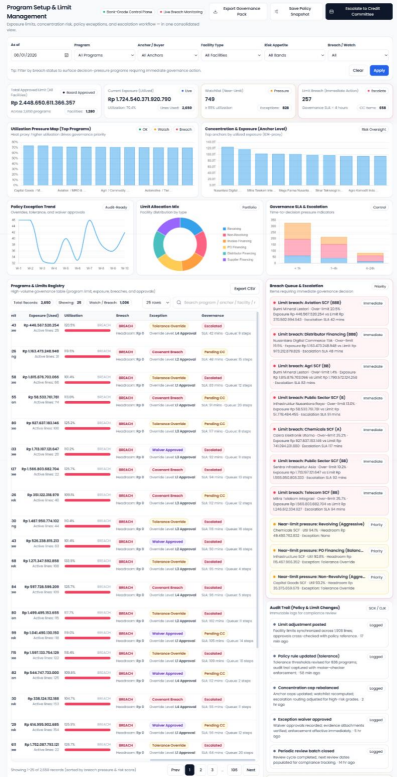

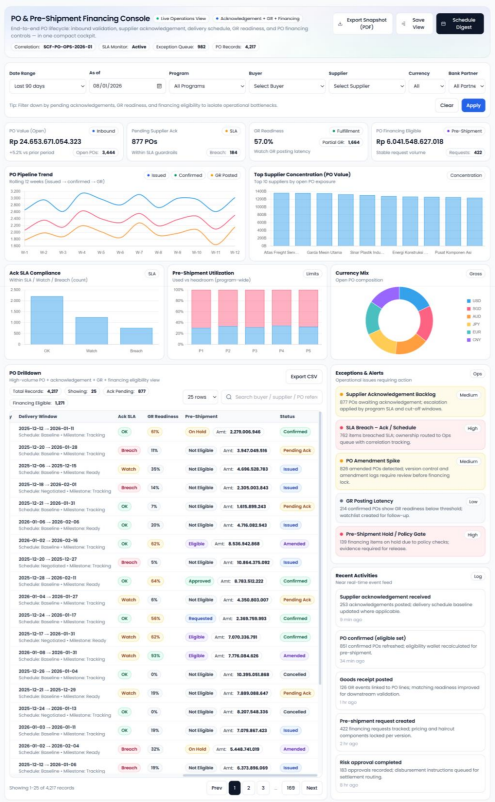

Core SCF Modules & High-Value Capabilities

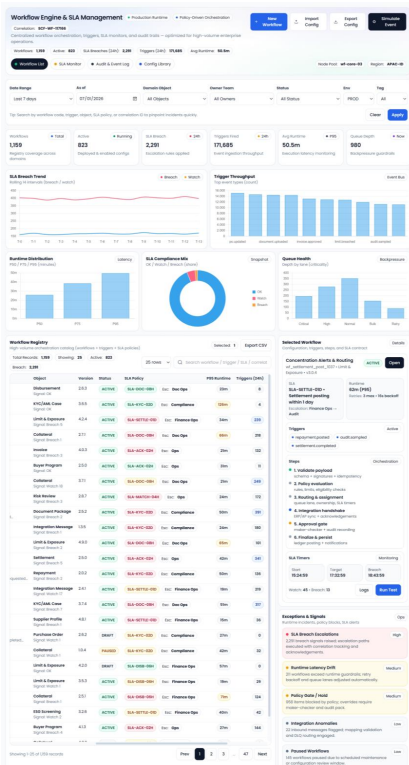

Rayterton SCF is architected as a modular yet fully integrated platform, purpose built to meet the stringent demands of regulated financial institutions while preserving operational agility. The architecture is designed to strike a deliberate balance between flexibility and enterprise-grade cohesion, allowing banks to scale their Supply Chain Finance capabilities without compromising control, security, or compliance.

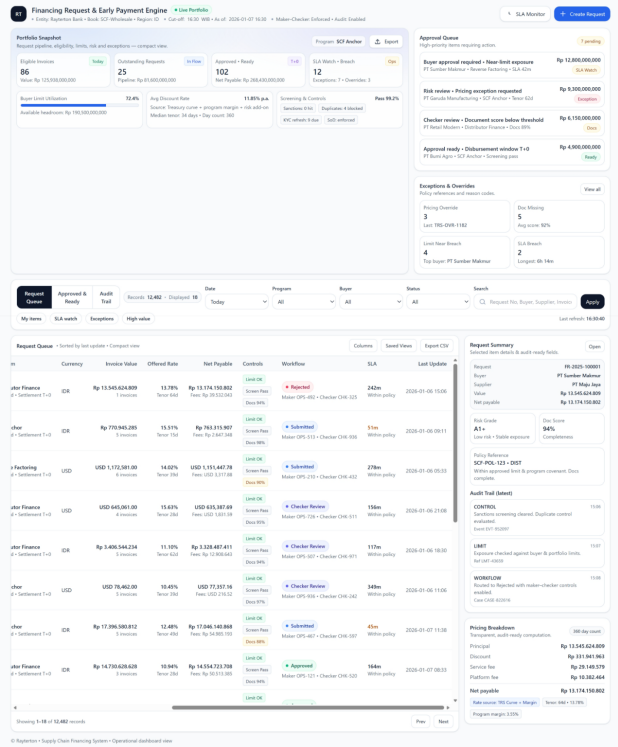

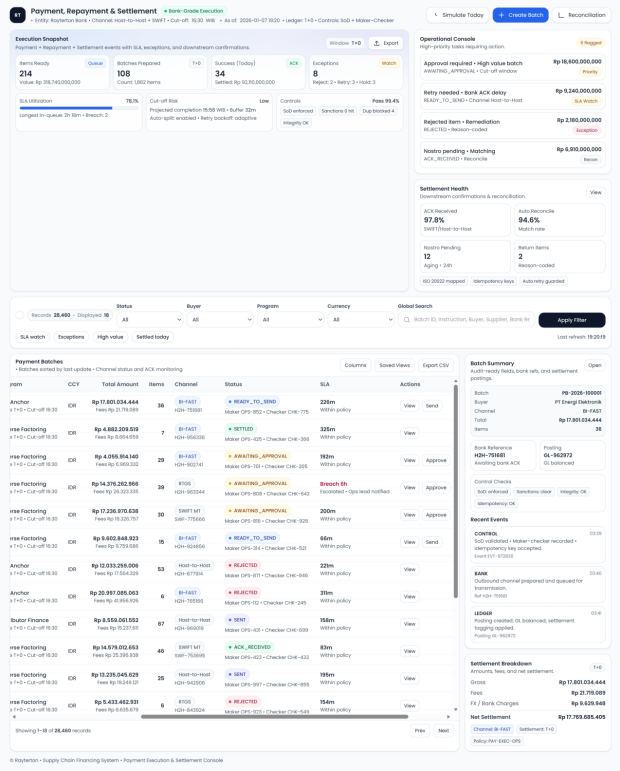

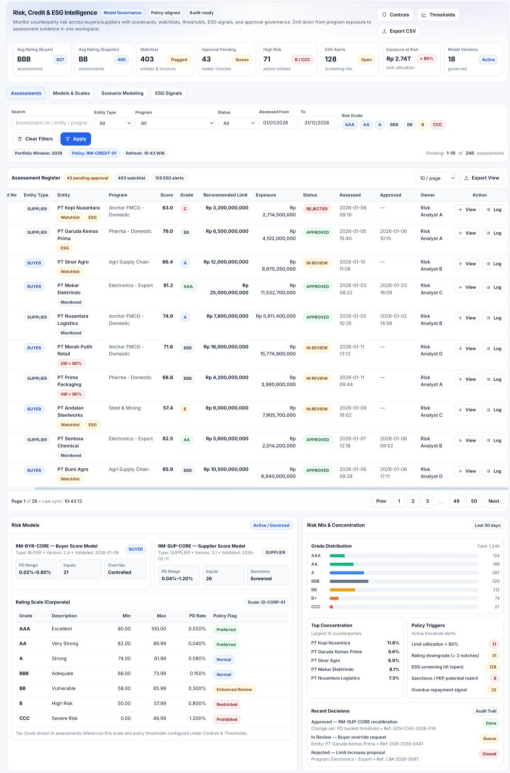

Each functional module ranging from onboarding, limit management, transaction processing, risk monitoring, to settlement and reporting delivers clear and measurable standalone value. This modularity enables institutions to deploy and activate capabilities incrementally, aligned with strategic priorities, product rollout timelines, and market readiness, without creating system fragmentation or technical debt