Why Enterprise LOS?

In an environment demanding transparency, speed, and regulatory compliance, banks require more than a credit processing system. Enterprise LOS empowers banks to proactively manage risk, improve business conversion, and provide complete visibility to management across the lending portfolio.

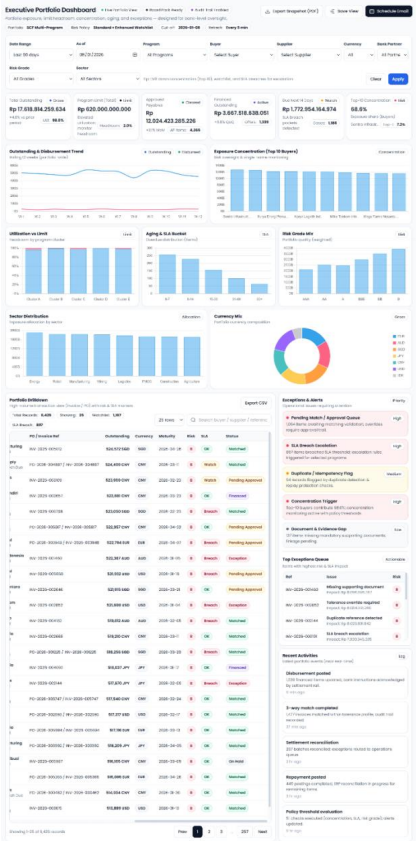

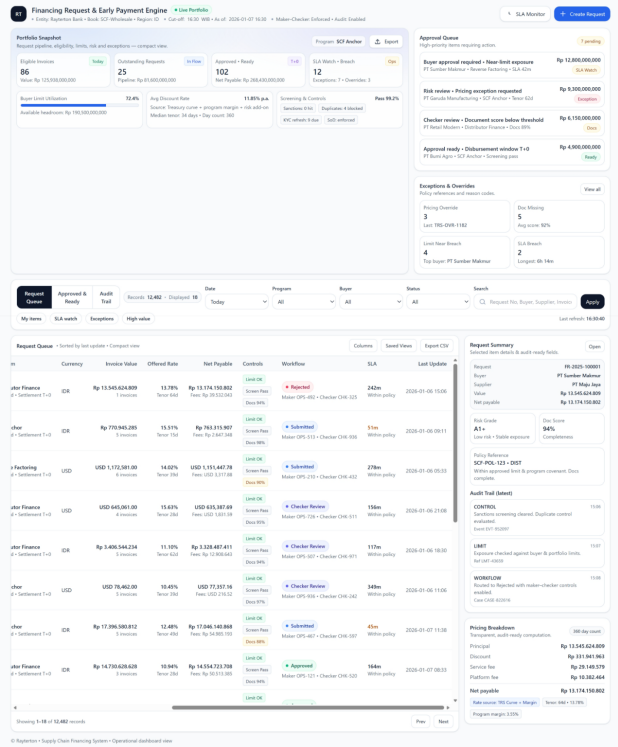

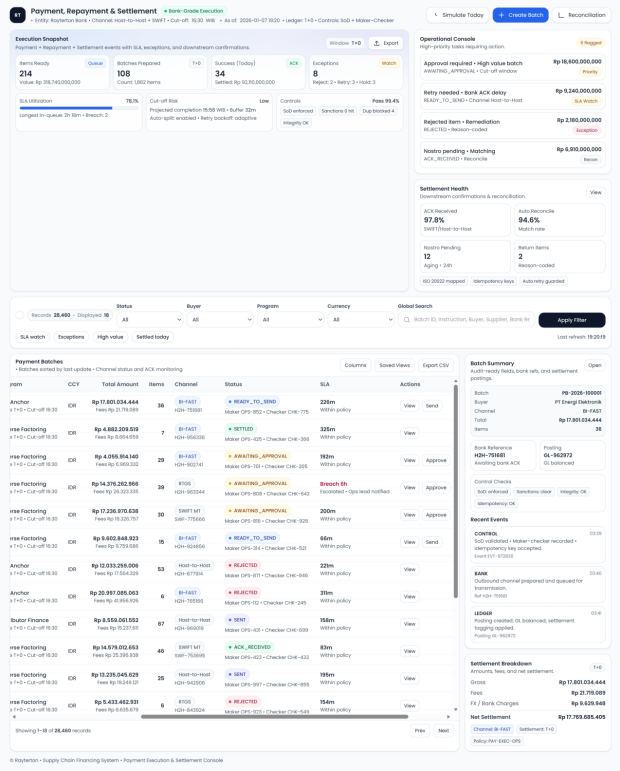

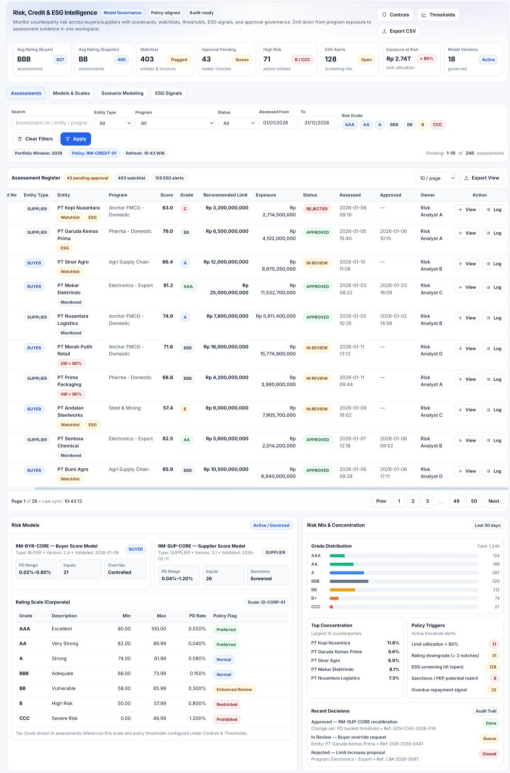

Executive LOS Dashboard

A single, integrated control tower empowers bank management to seamlessly oversee the entire credit pipeline across Retail, Small and Medium Enterprises (SME), and Corporate segments in real time, ensuring visibility, efficiency, and strategic control

Key advantages

- Realtime loan pipeline visibility

- Approval rate and turnaround time (TAT)

- Risk exposure snapshot

- Service Level Agreement (SLA) and bottleneck monitoring