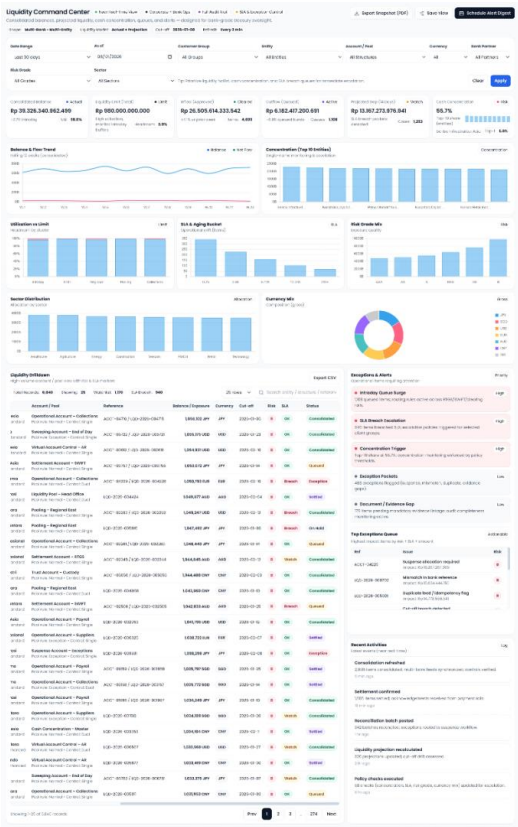

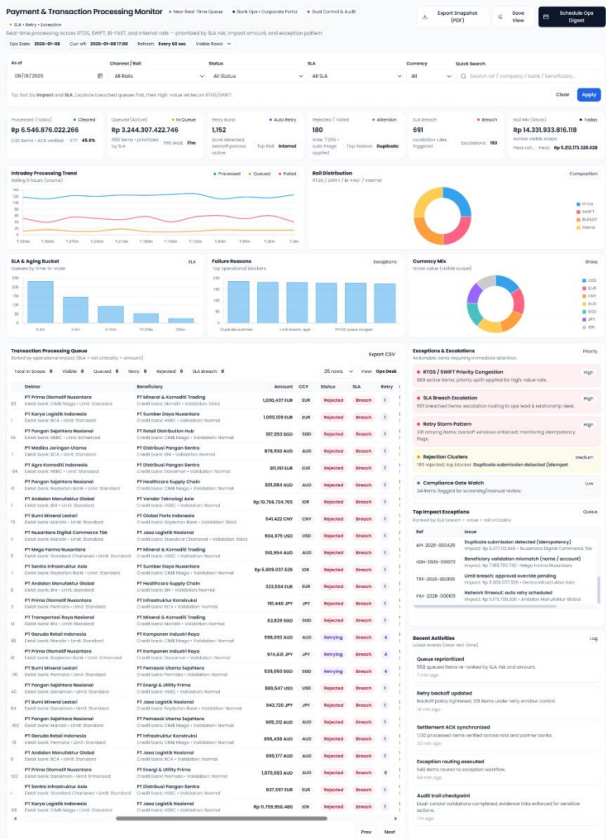

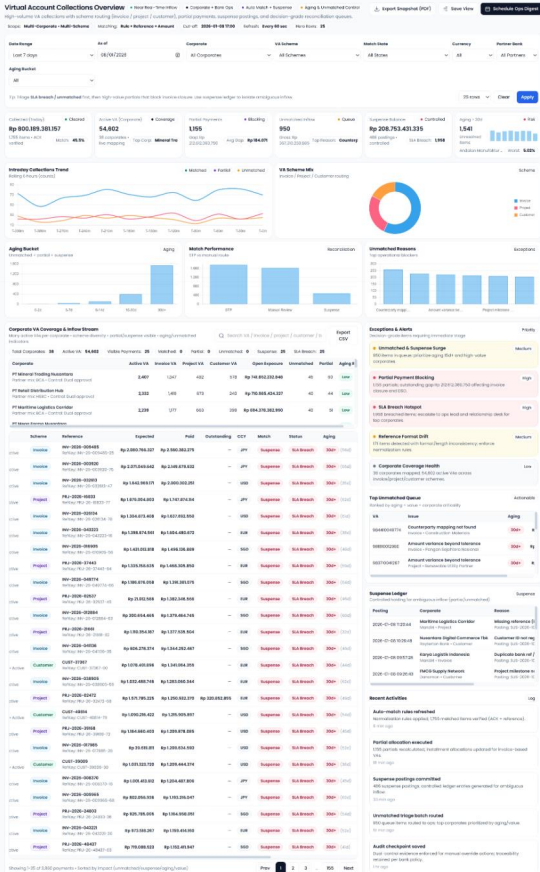

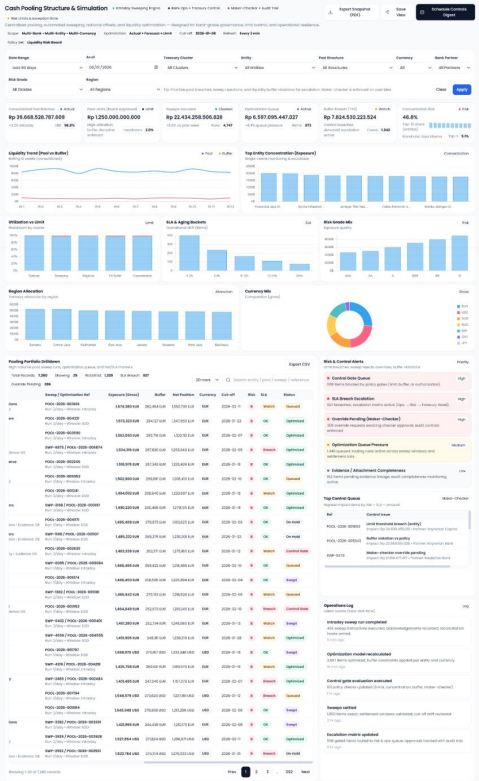

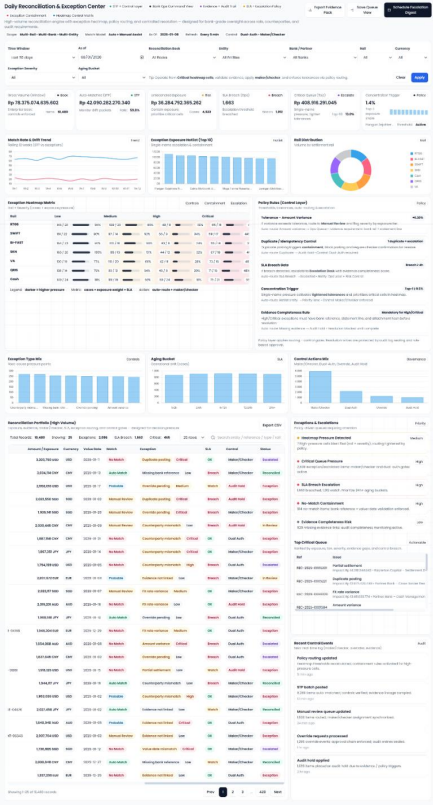

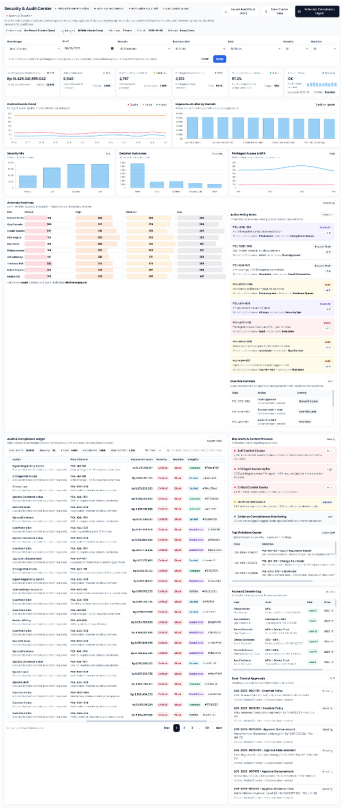

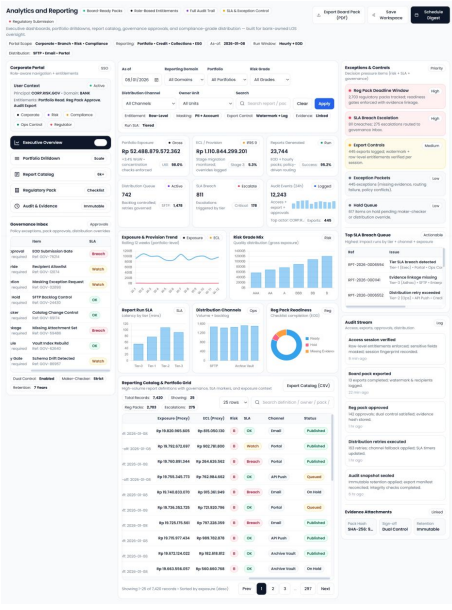

Real Time Cash Visibility & Liquidity Control

Turn fragmented views of cash into one consolidated picture. The BCM dashboards give both bank teams and corporate treasurers near real-time visibility of balances, projected cash positions, and transaction queues across all operational, collection, and pooling accounts. By aggregating data from multiple banks and entities into a single, intuitive interface, decision makers gain a clear and reliable source of truth.

Key advantages

- Unified cash position for every corporate, across physical and pooling accounts

- Daily volumes, success and failure rates, and Service Level Agreement (SLA) alerts at a glance

- Liquidity hot list to highlight key clients and structures that require attention

- Direct drill down from summary widgets to transaction and account level detail